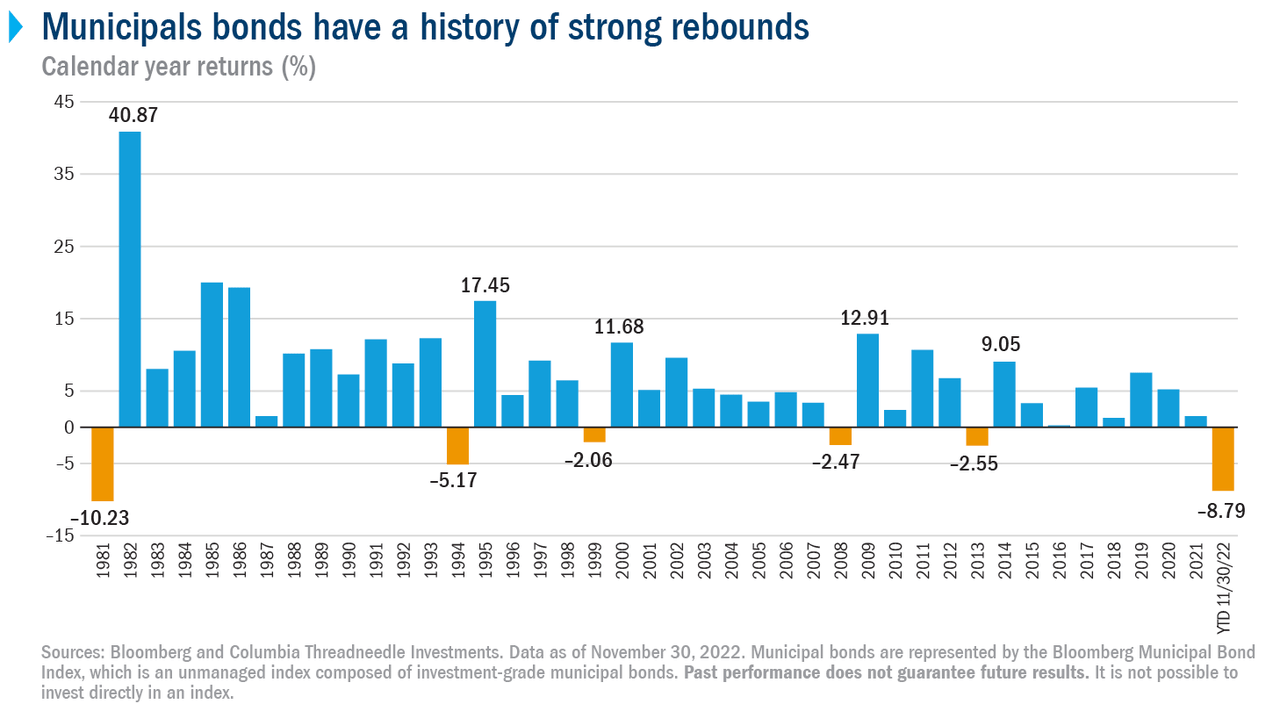

As we look ahead to 2023, municipal bond investors have a lot to be optimistic about. With a current supply and demand imbalance in the market and buying opportunities on the horizon, now is an ideal time to consider investing in municipal bonds. In this article, we’ll explore why that is, what the current market dynamics are, and where you should look for the best buying opportunities.

Introduction

Municipal bonds have long been a staple investment for those looking for income and tax-exempt interest, but the current market conditions are creating opportunities for investors to get even more out of their muni bond investments.

Muni bonds are debt securities issued by state and local governments to finance public projects like infrastructure or schools. They typically offer higher yields than other types of fixed-income investments, making them attractive to income-seeking investors.

But the combination of low interest rates and strong investor demand has led to a tight supply of muni bonds, driving up prices and pushing yields down to historically low levels.

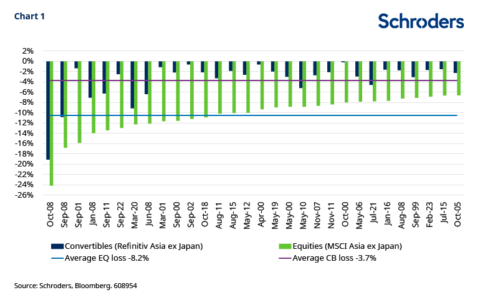

However, the recent sell-off in the stock market has created a buying opportunity for muni bonds. With investors fleeing riskier assets in search of safety, muni bond prices have risen and yields have fallen even further.

For income-seeking investors, this is an ideal time to add muni bonds to your portfolio. The combination of low interest rates and strong demand means that muni bond prices are likely to continue to rise, providing you with capital gains as well as tax-free income.

Overview of the Municipal Bond Market

The municipal bond market is in the midst of a structural change that is benefiting investors. The key drivers of this change are an imbalance between supply and demand, and the resulting tightness in the market. This has led to higher prices and lower yields for municipal bonds, and has created opportunities for investors who are willing to take on more risk.

The imbalance between supply and demand in the municipal bond market is the result of several factors. First, there has been a decrease in the number of new issues coming to market. This is due to a combination of factors, including lower government spending and fewer refinancings. Second, there has been an increase in demand from investors, as they seek out safe investments that offer higher yields than other fixed-income options.

The tightness in the municipal bond market has led to higher prices and lower yields. This means that investors who are willing to take on more risk can find attractive opportunities in the market. However, it is important to remember that municipal bonds are still subject to credit risk, so it is important to do your homework before investing.

Supply and Demand Imbalances in 2023

The U.S. municipal bond market is on the cusp of a structural change that will provide opportunities for investors in the coming years. The market is currently facing a supply and demand imbalance, with more bonds being issued than there are buyers to purchase them. This dynamic is expected to shift in 2023, when the number of bonds maturing will exceed new issuance for the first time in nearly a decade.

As a result, prices for municipal bonds are expected to rise and yields to fall as demand outpaces supply. This will create an attractive environment for investors looking to purchase bonds, as they will be able to do so at relatively low prices. In addition, the increased demand for municipal bonds is expected to lead to more competitive bidding from issuers, resulting in higher coupon rates and better terms for investors.

With the municipal bond market poised for favorable conditions in 2023, now is an ideal time to begin positioning portfolios for potential buying opportunities. Investors who are patient and disciplined in their approach are likely to be rewarded with attractive returns over the long term.

Impact of Interest Rates on Municipal Bonds

The rise in interest rates has had a negative impact on the prices of municipal bonds. The demand for these bonds has decreased as investors have shifted their money into other investments that offer higher returns. This has caused the prices of municipal bonds to decline and created opportunities for investors who are willing to take on more risk.

The decrease in demand for municipal bonds has been driven by two factors:

1) The rise in interest rates: When interest rates go up, the price of a bond goes down. This is because investors can get a higher return by investing in other products such as stocks or mutual funds. As a result, the price of municipal bonds has declined as interest rates have risen.

2) The change in tax laws: The new tax laws passed by Congress in December 2017 reduced the benefits of owning municipal bonds for many taxpayers. Prior to the tax reform, investors could deduct the interest payments they made on their municipal bonds from their taxable income. However, the new tax law capped this deduction at $10,000 for individuals and $20,000 for couples filing jointly. For many taxpayers, this change reduces the incentive to own municipal bonds. As a result, demand for these bonds has declined.

Despite the challenges faced by the municipal bond market, there are still some reasons to be optimistic about its future. First, the supply of these bonds is expected to decrease in 2019 as state and local governments issue fewer bonds than they have in recent years. This should help to stabilize prices and reduce volatility in the market. Second, the interest rates on municipal bonds are still relatively low compared to other investments, making them an attractive option for investors who are seeking a safe and reliable source of income. Finally, there is potential for demand for these bonds to increase if Congress passes legislation that would reinstate the full deduction on municipal bond interest payments.

Opportunities for Investors in 2023

Municipal bonds offer opportunities for investors in 2023. The market is currently benefiting from a supply and demand imbalance, which is driving prices higher and yields lower. This trend is expected to continue in the near term, making municipal bonds an attractive investment option.

There are a number of reasons why the municipal bond market is currently favorable for investors. First, there has been a decrease in new issuance of municipal bonds, while demand for these securities has remained strong. This has led to a tightening of the market, causing prices to rise and yields to fall.

Second, the U.S. Federal Reserve has signaled that it plans to keep interest rates low for the foreseeable future. This policy is supportive of the bond market, as it makes fixed-income securities more attractive relative to other investments such as stocks.

Finally, muni bonds offer tax-exempt status, which can be beneficial for investors in high tax brackets. In addition, many muni bonds are backed by the full faith and credit of state or local governments, providing a measure of safety for investors.

Given these factors, municipal bonds appear to be a compelling investment option for 2023. Investors should consider allocating a portion of their portfolio to these securities in order to take advantage of the current market conditions.

Advantages of Investing in Longer Term Bonds

Investing in municipal bonds has several advantages, especially if you are looking to invest for the long term. One of the biggest advantages is that municipal bonds are typically exempt from federal taxes, and in some cases, state and local taxes as well. This can make them a very attractive investment option for those who are looking to minimize their tax liability. Additionally, municipal bonds tend to be more stable than other types of investments, such as stocks or mutual funds. This makes them a good choice for investors who are risk-averse or who are looking to preserve their capital.

Another advantage of investing in municipal bonds is that they often offer higher yields than other types of bonds. This can provide investors with a good source of income, particularly if they reinvest the interest payments back into the bond. Additionally, because municipal bonds are not exposed to the ups and downs of the stock market, they can provide a measure of stability for portfolios that contain volatile assets like stocks.

Finally, municipal bonds can be an excellent way to diversify your portfolio. Because they tend to move independently of other asset classes, they can help reduce overall portfolio risk. For these reasons, investing in municipal bonds can be a smart choice for long-term investors who are looking for stability and income.

Risk Considerations for Investors

When considering investing in municipal bonds, it is important to be aware of the potential risks involved. While muni bonds offer many advantages, there are a few key risks to be aware of before making any investment decisions.

Interest Rate Risk:

Municipal bonds are subject to interest rate risk. This means that if market interest rates rise, the value of your bond will likely fall. This is because when rates go up, investors are looking for higher yields and are willing to pay less for existing bonds with lower yields. If you need to sell your bond before it matures, you may not get back the full amount you originally paid.

Default Risk:

Although it is relatively rare, another risk to consider is the possibility of default. This happens when the issuer of the bond is unable to make scheduled interest or principal payments. This can happen due to financial difficulties or simply poor management. Default risk is higher for bonds with lower credit ratings. As such, it is important to research the issuer of any bond before investing.

Reinvestment Risk:

Another risk associated with municipal bonds is reinvestment risk. This occurs when investors need to reinvest their money at a lower interest rate than their original investment earned. This can happen when market interest rates fall after an investor buys a bond. While this doesn’t necessarily mean you will lose money on your investment, it does mean you may not earn as much as you expected.

Call Risk:

Finally, there is call risk associated with municipal bonds. This means that the issuer of the bond can pay off their debt early, forcing the investor to reinvest their money at a lower rate than they initially expected. To protect against this risk, investors should look for bonds with longer terms and higher yields.

Conclusion

In summary, the 2023 municipal bond market outlook is positive due to a supply and demand imbalance. Investors may have an opportunity to benefit from this disparity by taking advantage of buying opportunities that exist as a result. This could be done through higher yields and lower credit spreads, which would benefit both investors looking for income or capital gains in the short term. Additionally, municipalities may also take steps to improve their bonds’ ratings over time, further benefiting those who invest in them.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/2023-municipal-bond-outlook.html