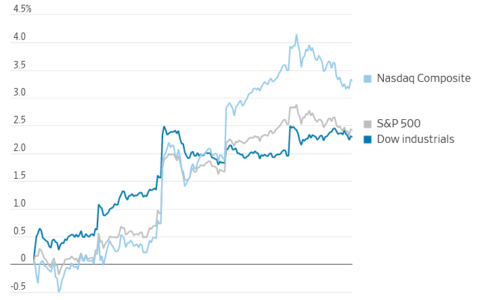

There’s a curious trend afoot on Wall Street, one that may be a harbinger of things to come. After months of surprisingly resilient market performance, a capitulation among the bearish big-name investors has begun to emerge. This change in tune comes just as the market has started to falter. The timing and nature of these developments should warrant concern for those paying attention to the financial markets.

The Changing Tide: Bears Retreating

The June and July short-covering among Goldman Sachs’ hedge fund clients has been the most significant over a two-month period in the past seven years, according to The Wall Street Journal. Notable investors are either shuttering their bearish bets or moderating their negative views.

For instance, Morgan Stanley’s strategist Mike Wilson, widely criticized for his pessimistic market outlook, has turned less bearish. Carl Icahn, the famous activist investor, has shifted his stance as well. In a recent letter to Icahn Enterprises’ investors, he pledged to reduce his emphasis on hedging stocks and to focus more on activism, stating, “Activism is the best investment paradigm.”

These moves may elicit some schadenfreude from market watchers, but such a reaction could be misguided, especially for those who were fortunately positioned for the 2023 rally.

Earnings Concerns: The Warning Signs

This capitulation coincides with a subtle but important shift in the market’s narrative. Investors are becoming increasingly worried about slowing corporate earnings. Oppenheimer’s John Stoltzfus has recently reported that S&P 500 companies’ earnings seem weaker than expected, down 7.8%, compared to a predicted decline of 6.4%.

Other concerning signs include Fitch’s recent downgrade of the U.S. debt rating, Moody’s downgrading of 10 regional banks, and the 10-year Treasury yields rising above 4%. The latter is historically harmful for technology stocks, primarily due to the adverse impact of higher interest rates on the discounted-cash-flow models used to value these stocks.

The Looming Threats: Real Estate and Recession

Moreover, the unsettling troubles brewing in the real estate sector, coupled with uncertainty regarding recession odds, could spell financial unrest. These factors are the ingredients for a perfect storm of financial indigestion.

The Prudent Approach: Consider Hedging

If you find yourself in agreement that the market narrative is indeed changing and are concerned that the bearish sentiment is prematurely fading, it may be wise to consider protecting the impressive gains of 2023. Hedging expenses are still reasonable, with the Cboe Volatility Index (VIX) remaining below its long-term average of 19.

As suggested by Michael Schwartz, Oppenheimer’s chief market strategist, buying three S&P 500 November $4450 put options to hedge a $1 million portfolio could be a strategic move. If the market falls 10%, this hedge would offset about 95% of any losses.

Timing and Caution

It is worth noting that most bullish investors tend to wait to hedge or lock in profits until panic sets in. The end of summer will bring several events that could prompt investors to sell stocks, including major market declines typical of the September and October trading months, Federal Reserve meetings, and vital economic data parsed for inflation clues.

Should stocks rally into the fall, money spent hedging will be lost, but that’s a risk that could be considered well worth taking in these uncertain times.

Conclusion

The shift in the investing world from bearish skepticism to something akin to complacency should be viewed with caution rather than celebration. The convergence of declining corporate earnings, credit rating downgrades, the threat of higher interest rates, and potential real estate troubles signals a changing tide.

Investors who act prudently, with a keen eye on hedging strategies, may find themselves better positioned to navigate the uncertain waters ahead. Remember, the market’s skeptics are giving up; it might just be time to worry.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/shifting-tides-on-wall-street-why-the-retreat-of-market-skeptics-should-be-your-signal-to-worry.html