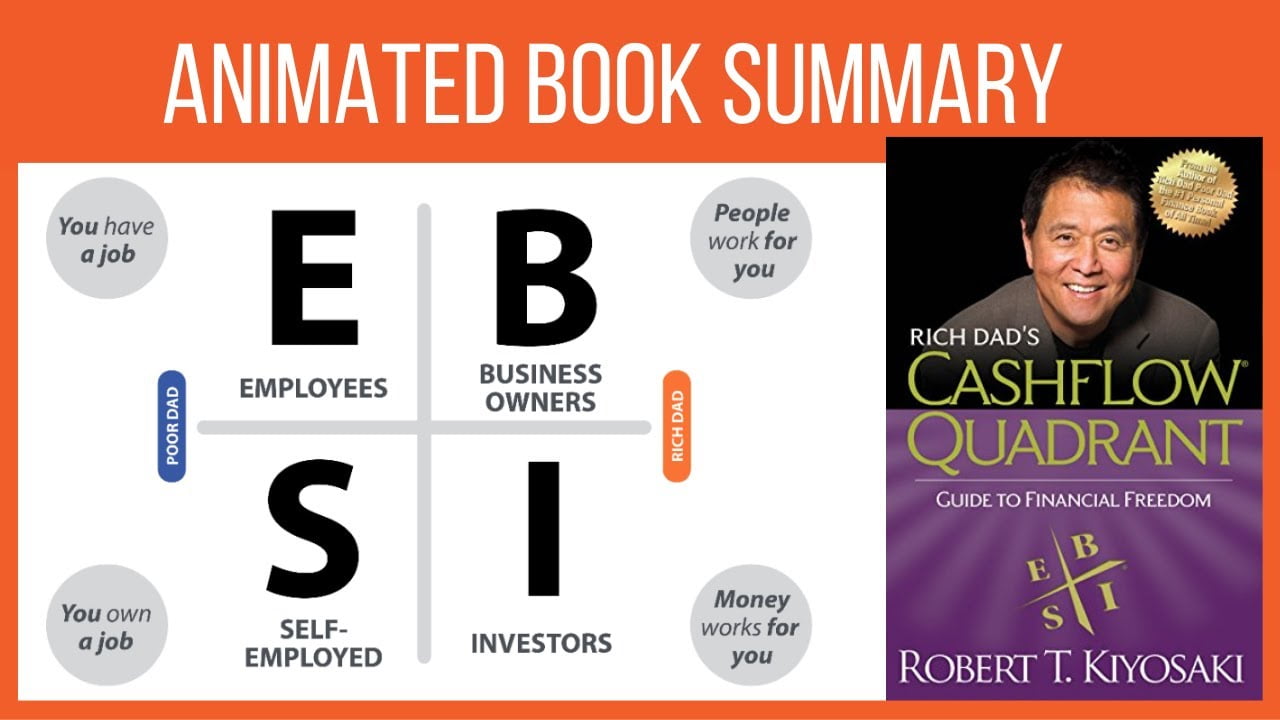

“Cashflow Quadrant” is a book written by Robert Kiyosaki, the author of the best-selling personal finance book “Rich Dad Poor Dad.” In “Cashflow Quadrant,” Kiyosaki delves deeper into the concept of financial education and provides a framework for understanding the different ways in which people make money. The book is divided into four sections, each corresponding to one of the four quadrants of the “Cashflow Quadrant” – E (employee), S (self-employed), B (business owner), and I (investor).

One of the key themes of the book is the importance of financial education and understanding the difference between assets and liabilities. Kiyosaki stresses that in order to become financially successful, one must acquire assets, such as real estate, stocks, or businesses, that generate income, and minimize liabilities, such as credit card debt or car loans, that drain income. He also encourages readers to think differently about money and work and to seek alternative ways to earn money, such as starting their own business or investing in real estate.

The book is divided into four sections, each corresponding to one of the four quadrants of the “Cashflow Quadrant” – E (employee), S (self-employed), B (business owner), and I (investor). He explains that people tend to fall into one of these quadrants, and that the key to financial success is to move from the left side of the quadrant (E and S) to the right side (B and I). The left side of the quadrant represents those who work for money and the right side represents those who have money work for them. By understanding the characteristics and opportunities of each quadrant, readers can identify where they currently stand, and work towards shifting to the right quadrant, where they can achieve financial freedom.

In the E quadrant, Kiyosaki explains that employees rely on the security of a regular paycheck and benefits, but have limited control over their financial future. He encourages readers to consider the benefits of becoming self-employed (S quadrant) or a business owner (B quadrant) in order to gain more control over their finances. The S quadrant represents self-employed individuals who have more control over their finances than employees, but still rely on their own effort to generate income. In the B quadrant, Kiyosaki explains that business owners have the most control over their financial future, as they can create systems and processes that generate income without their own direct effort.

Finally, in the I quadrant, Kiyosaki explains that investors have the most control over their financial future, as they can generate income from assets that they own, such as stocks, bonds, or real estate. He emphasizes the importance of learning how to invest and how to generate passive income through investments.

Throughout the book, Kiyosaki shares personal stories and experiences from his own life, making the book an engaging and easy-to-read guide to personal finance. He also provides actionable advice and practical steps for readers to follow to achieve financial success.

In conclusion, “Cashflow Quadrant” is a must-read for anyone looking to improve their financial literacy. Kiyosaki’s writing is engaging, and he shares valuable insights and practical advice on how to acquire assets, minimize liabilities, and achieve financial independence. His message is timeless and his approach to personal finance is one that is easy to understand and implement. The Cashflow Quadrant framework is a powerful tool that can help readers understand their current financial situation and identify opportunities to improve it. This book is a great follow-up to “Rich Dad Poor Dad” and provides more in-depth and actionable advice for achieving financial success.

One of the strengths of the book is its ability to break down complex financial concepts into simple and easy-to-understand terms. The quadrant framework provides a clear visual representation of the different ways in which people make money and the opportunities and challenges associated with each quadrant. This makes it easy for readers to identify where they currently stand and what steps they need to take to move to the next quadrant.

Another strength of the book is Kiyosaki’s emphasis on taking action. Throughout the book, he encourages readers to take control of their finances and to start taking steps towards achieving financial freedom. He provides practical advice and tips on how to acquire assets, minimize liabilities, and generate passive income.

In conclusion, “Cashflow Quadrant” is an excellent book for anyone looking to improve their financial literacy and achieve financial freedom. The book provides a clear framework for understanding the different ways in which people make money and the opportunities and challenges associated with each quadrant. Kiyosaki’s writing is engaging, and he shares valuable insights and practical advice on how to acquire assets, minimize liabilities, and achieve financial independence. The book is a great follow-up to “Rich Dad Poor Dad” and provides more in-depth and actionable advice for achieving financial success.

Or the Kindle Version:

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/unlocking-financial-freedom-a-review-of-robert-kiyosakis-cashflow-quadrant.html