Introduction:

As we approach the end of 2023, the financial markets are experiencing a resurgence reminiscent of spring, with both stocks and bonds making robust gains. The prospect of the Federal Reserve concluding its prolonged rate-hiking campaign has injected confidence into investors, paving the way for a potential continuation of the bull market into 2024. While uncertainties always loom, the optimism surrounding a strong Santa rally and the possibility of rate cuts in the coming year paint a promising picture. In this in-depth analysis, we will explore the factors driving this market sentiment, potential risks, and the outlook for 2024.

- A Santa Rally to Remember:

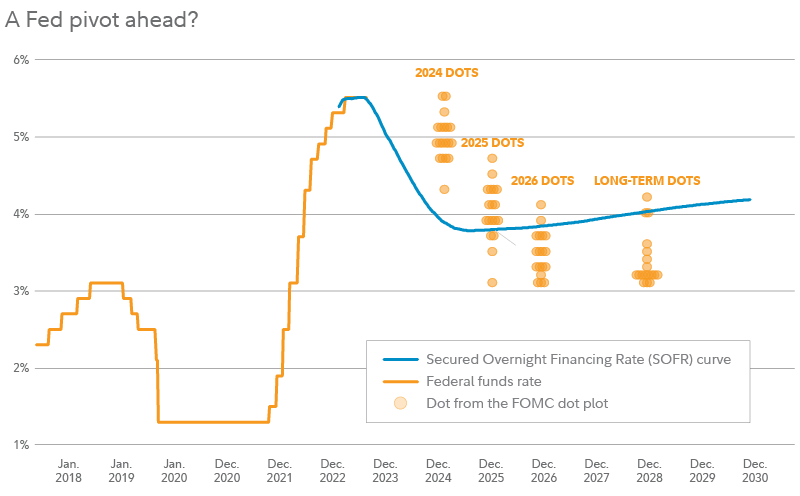

The closing months of 2023 have seen a remarkable shift in market dynamics. Previously characterized by narrow leadership, the market witnessed a turning point around November, coinciding with growing confidence that the Fed had concluded its rate hikes. This newfound optimism has fueled a broad-based rally, propelling both stocks and bonds to higher levels. The release of the Fed’s economic projections, hinting at potential rate cuts in 2024, further solidified the belief that the era of rate hikes might be behind us.

- The Fed Projects a Pivot:

The driving force behind the recent market rally lies in the perception that the Fed is poised for a significant pivot. The updated dot plot, a visual representation of committee members’ views on future monetary policy, indicates a potential for three rate cuts in 2024. This shift is attributed to the improving inflation outlook since its peak in June 2022. As the Fed considers giving back some of its rate hikes, the focus now shifts to how quickly and how much it can safely adjust its monetary policy.

- Outlook for 2024:

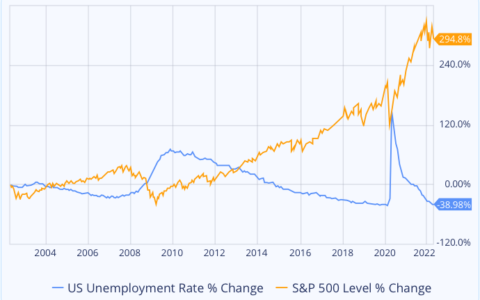

Building on the expectation of a Fed pivot and rate cuts, the base case for 2024 is a continuation of the bull market. The broadening of the bull market is anticipated, with various types of stocks advancing, marking a departure from the narrow leadership seen in much of 2023. Earnings, a crucial driver of market performance, seem to be rebounding after a contraction in the third quarter of 2023. The historical context of bear markets suggests that, unless a recession is imminent, the market could be due for new highs, given the recovery timeframes observed in non-recessionary bear markets.

- Risks to the Outlook:

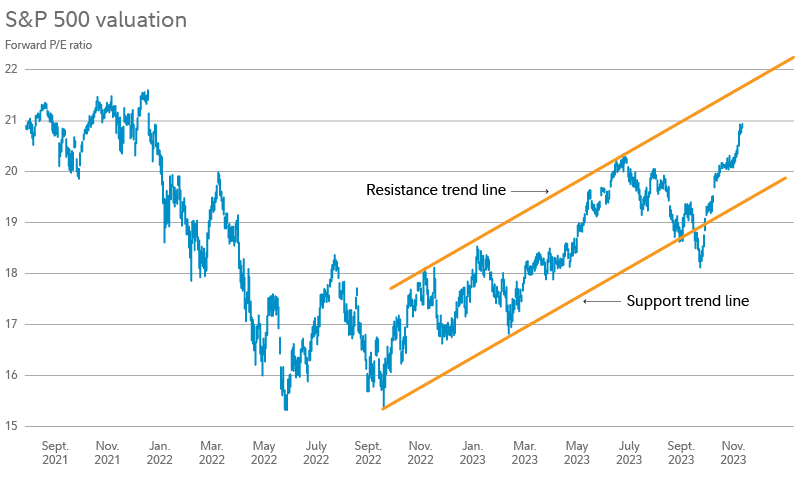

While the outlook is optimistic, potential risks lurk on the horizon. The Fed’s ability to navigate a soft landing and the timing of rate cuts is crucial. A premature pivot towards a hawkish stance could jeopardize progress in core inflation, posing a risk to the overall economic stability. Additionally, the market may have already priced in much of the soft-landing narrative, leaving limited room for substantial gains. The forward P/E ratio’s increase anticipates an earnings recovery, but the impact on stock prices may be tempered by falling P/E ratios.

- The Market Continues its Dance:

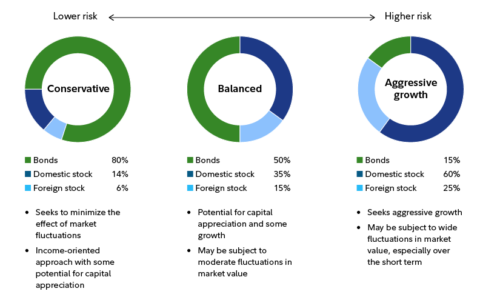

Market outlooks are a blend of science and art, analysis and intuition. The narrative of the market is akin to a dance, oscillating between recession fears and inflation concerns. As 2024 unfolds, the direction of this dance remains uncertain, with a hunch towards the right tail in the second half of the year. Regardless, the key is preparedness. Diversified portfolios, balanced with stocks and bonds, remain a prudent approach in the face of market dynamics that are ever-evolving.

Conclusion:

In conclusion, the 2024 stock market outlook is marked by optimism driven by potential rate cuts and earnings growth. While risks persist, staying attuned to the Fed’s actions, market dynamics, and maintaining a diversified portfolio can position investors to navigate the uncertainties and capitalize on potential opportunities. The market’s inherent dynamism guarantees that, regardless of the direction it takes, adaptability and a balanced approach will remain essential for investors seeking to thrive in the year ahead.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/2024-stock-market-outlook-navigating-a-bull-market-with-earnings-growth-and-falling-rates.html