Despite the evident decrease from the 9.1% inflation spike in 2022, most consumers still feel the strain on their wallets. Research as of June 2023 indicates a staggering 61% of Americans are living paycheck to paycheck, with 21% finding it hard to meet their monthly bills. Even among the higher earners—those with incomes ranging from $50,000 to $100,000—65% are in the paycheck-to-paycheck boat.

So, what exactly is going on?

The Direction of Inflation

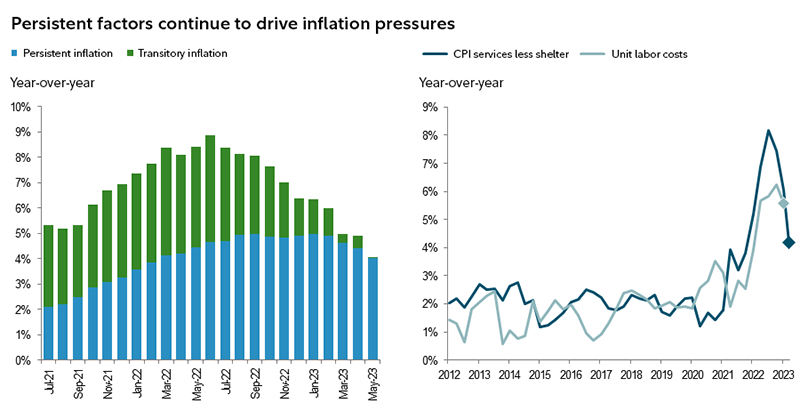

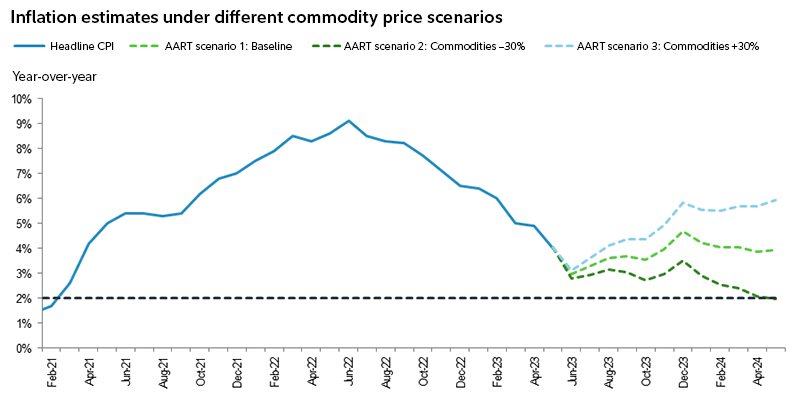

Collin Crownover, PhD, a research analyst with Fidelity’s Asset Allocation Research Team, opines that the economic underpinnings have undergone significant shifts over the past 5-10 years. Historically, inflation maintained a steady rate slightly below 2%. Crownover suggests that we might see this number inch towards a range of 2.5% to 3% in the coming decades.

The root cause? Persistent demand pressures, replacing the global supply chain hitches that previously fueled inflation. As Crownover puts it, “Inflation due to supply can be transient. But demand-based inflation, particularly in the form of rising wages due to labor shortages, is stickier.”

Take the service sector, for instance. Wages form a significant portion of service costs. Once wages increase, they rarely roll back, especially in professions like hairdressing or medical services. Therefore, higher costs in these domains seem almost inevitable.

The Federal Reserve’s ideal situation? Slower wage growth without job losses. While we’ve seen some deflation, the long-term sustainability of these decreases remains uncertain. Factors such as fluctuating commodity prices and entrenched wage hikes make the road to the Fed’s inflation targets a challenging one.

Shielding Yourself from the Impact of Inflation

Your best defense against inflation? Proactivity in your financial decision-making. Here are five steps you can consider:

- Reevaluate Your Spending: Sift through your card statements. Be on the lookout for unused subscriptions. Crownover suggests, “People frequently subscribe to multiple streaming services but only frequently use a fraction of them.”

- Diversify Your Income: Consider a side hustle or any opportunity to bring in extra cash. Remember, every bit helps.

- Bolster Your Emergency Fund: Fidelity recommends saving an amount that can cover 3-6 months of essential expenses. If that’s too ambitious, start with a target of $1,000 or a month’s worth of crucial expenses, and build from there.

- Optimize Your Cash: With yields on various financial instruments at a high, now might be the opportune time to invest and earn income on your surplus cash.

- Invest with a Focus on Growth: Your money needs to grow at or above the rate of inflation to maintain its purchasing power. Long-term goals, such as retirement, require the growth potential that stocks offer. Being too conservative, especially for those with time on their side, can be detrimental. As Crownover puts it, “Over-conservative investments like bonds get eroded by inflation. Diversifying with real assets can help your investments keep pace with inflation.”

In conclusion, while the exact trajectory of inflation remains uncertain, it’s clear that a proactive approach to your finances can help mitigate its impacts. Focus on what’s within your control, and consider diversifying your investments to ensure your money keeps up with—or outpaces—the inflation rate.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/5-proactive-steps-to-shield-your-finances-in-a-persistent-inflation-era.html