Introduction

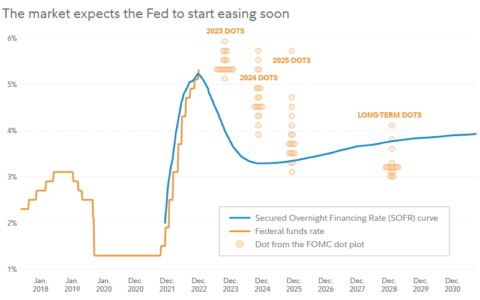

In the intricate dance between inflation, economic growth, and monetary policy, the Federal Reserve has recently hit the pause button on its relentless ascent of interest rates. With the federal funds rate resting in a range between 5.25% and 5.50%, investors are left wondering: Have interest rates peaked, and what lies ahead? In this blog post, we explore the Federal Reserve’s recent decisions, the potential trajectory of interest rates, and how investors can position themselves for the evolving financial landscape.

The Federal Reserve’s Pivot

After over a year of consecutive rate hikes, the Federal Reserve has opted for a cautious approach. The decision to halt further rate increases stems from the delicate balance the Fed seeks: curbing inflation while avoiding derailing the economy. Fed Chair Jerome Powell emphasizes the continued commitment to quelling inflation, which he deems a threat to both investors and consumers. However, the recent shift in tone suggests a potential shift in policy direction.

Forecasting the Future

The Federal Reserve, while refraining from explicit statements, hints at a possible downward move in interest rates in 2024. The December Summary of Economic Projections (SEP) indicates growing confidence in achieving a “soft landing” — a scenario where economic growth and inflation slow without plunging into a recession. Fidelity’s Kana Norimoto suggests that the combination of declining inflation and a robust job market increases the likelihood of rate cuts in the coming year. Speculations are rife that rates could decrease to 4.6% by the end of 2024.

Impact on Investors: Bond Market

The prevailing high interest rates have been a boon for investors in bonds, particularly those seeking income and capital preservation. As rates stabilize and potentially decline, investors may want to strategically consider longer-maturity investments to capitalize on current income opportunities. Bond mutual funds, in particular, could see a positive impact. Jeff Moore, manager of Fidelity Investment Grade Bond Fund, anticipates a robust recovery in the prices of high-quality corporate bonds once rate cuts are initiated.

Impact on Investors: Equities

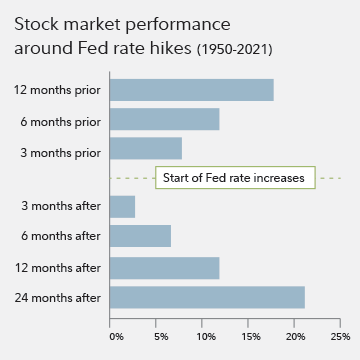

The relationship between interest rates and stocks is nuanced. The initial impact of rising rates has historically weighed on US stocks. However, the prospect of rate cuts could usher in a different narrative. Charting the current tightening cycle, initiated in May 2022, stocks have displayed resilience, recovering after an initial struggle. This historical pattern suggests that potential rate cuts might provide a short-term boost to equities.

Strategies for Investors

In this uncertain landscape, investors should remain vigilant and agile. For those heavily invested in fixed income, especially bonds, a proactive approach to portfolio realignment may be prudent. Consideration of longer-maturity investments, diversification, and monitoring the evolving interest rate scenario are key strategies.

Equity investors should keep a close eye on market dynamics. Potential rate cuts could offer opportunities in sectors that traditionally benefit from lower interest rates, such as technology and consumer discretionary. However, caution is advised, as the market’s response to changing interest rates can be unpredictable.

Conclusion

As the Federal Reserve charts a course to navigate through inflationary challenges, investors find themselves at a critical juncture. The possibility of interest rates retreating in 2024 introduces both opportunities and uncertainties. By staying informed, diversifying portfolios, and adapting strategies to the evolving financial landscape, investors can position themselves to thrive in a dynamic market environment. As we look ahead, the only certainty is the need for a vigilant and adaptable approach to investment decisions.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/6628.html