Introduction:

As we navigate the intricate landscape of financial markets, 2024 emerges as a year brimming with potential for equity investors. Amidst a backdrop of cooling inflation, robust economic growth, and signals of potential rate cuts from the Federal Reserve, the stage is set for continued stock market rally. In this blog post, we delve into three key bullish themes that suggest a promising outlook for stocks in the year ahead.

Accelerating Profit Growth: A Catalyst for Stock Gains

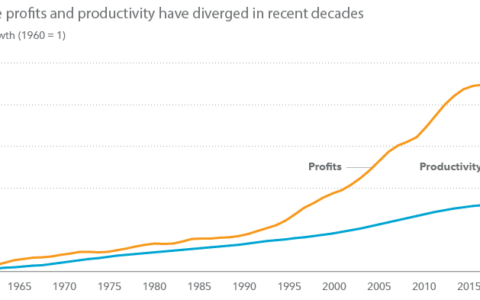

The resurgence of corporate earnings growth stands as a cornerstone of optimism for investors in 2024. After a period of tepid earnings performance, indications point towards a robust recovery in profitability. One driving force behind this resurgence is the divergence between consumer and producer inflation trends. As inflation cools faster for producers than for consumers, companies’ pricing power strengthens, bolstering profit margins.

Historically, when consumer inflation has outpaced producer inflation by comparable margins, corporate profit margins have increased significantly. Moreover, a decline in unit labor costs, propelled by heightened productivity, further augments corporate profitability. These favorable trends set the stage for a potential earnings recovery, with stock analysts forecasting strong earnings growth for S&P 500® companies in 2024.

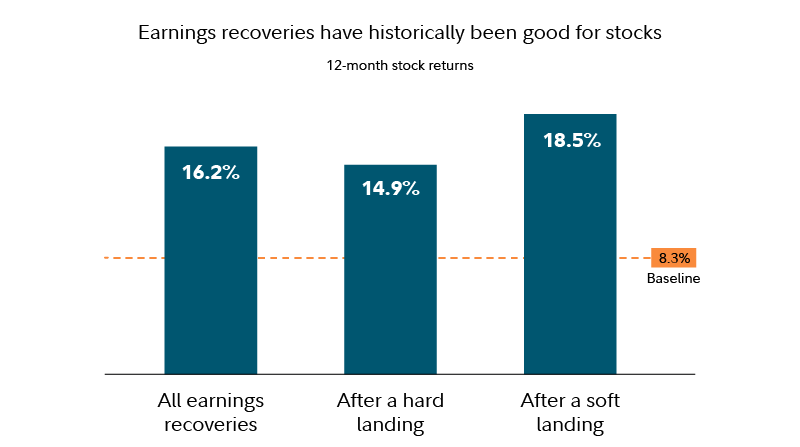

The historical correlation between earnings growth turning positive and subsequent stock market gains underscores the significance of this development. As earnings regain momentum, the potential for stock prices to follow suit remains compelling.

Potential Rate Cuts: A Tailwind for Equity Markets

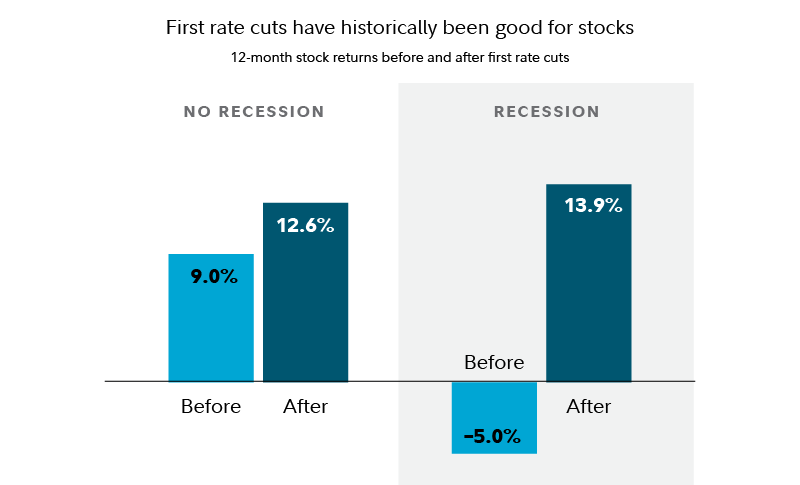

The Federal Reserve’s pivot towards considering rate cuts in 2024 adds another dimension to the bullish case for stocks. Following a series of rate hikes, the prospect of monetary policy easing injects optimism into equity markets. Historical analysis reveals the positive impact of the first rate cut in previous cycles, particularly in non-recessionary environments.

While economic forecasting entails uncertainties, indicators suggest a favorable outlook, supported by solid economic growth, robust employment figures, and healthy corporate earnings projections. As the Fed contemplates rate cuts, the historical precedent suggests favorable outcomes for stock prices, irrespective of the recessionary backdrop.

Cyclical Sectors: A Beacon of Opportunity, with Financials Leading the Charge

In the evolving economic landscape of 2024, cyclical sectors emerge as attractive investment opportunities, poised to benefit from falling interest rates and rising earnings. Notably, financials stand out as particularly well-positioned, characterized by compelling valuations and the potential for outperformance.

Historical analysis underscores the significance of financial stocks’ valuations relative to their historical range. When financials’ forward price-to-earnings ratio (P/E) hits bottom quartiles historically, the sector has exhibited a propensity to outperform the broader market over the subsequent twelve months. Additionally, in environments of declining interest rates, financials have demonstrated a track record of robust performance, further enhancing their allure as investment prospects.

Conclusion:

While past performance does not guarantee future results, the confluence of factors shaping the investment landscape in 2024 presents a compelling case for stock market optimism. Accelerating profit growth, potential rate cuts, and the attractiveness of cyclical sectors, particularly financials, collectively contribute to a bullish outlook for equities.

As investors navigate the complexities of financial markets, prudent analysis and strategic allocation of resources remain paramount. By embracing opportunities presented by evolving economic dynamics, investors can position themselves to capitalize on potential stock market gains in the year ahead. While uncertainties persist, the prevailing winds of change suggest that 2024 holds promise for astute investors seeking to unlock the potential of equity markets.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/decoding-2024-3-key-reasons-why-stocks-could-shine.html