Introduction:

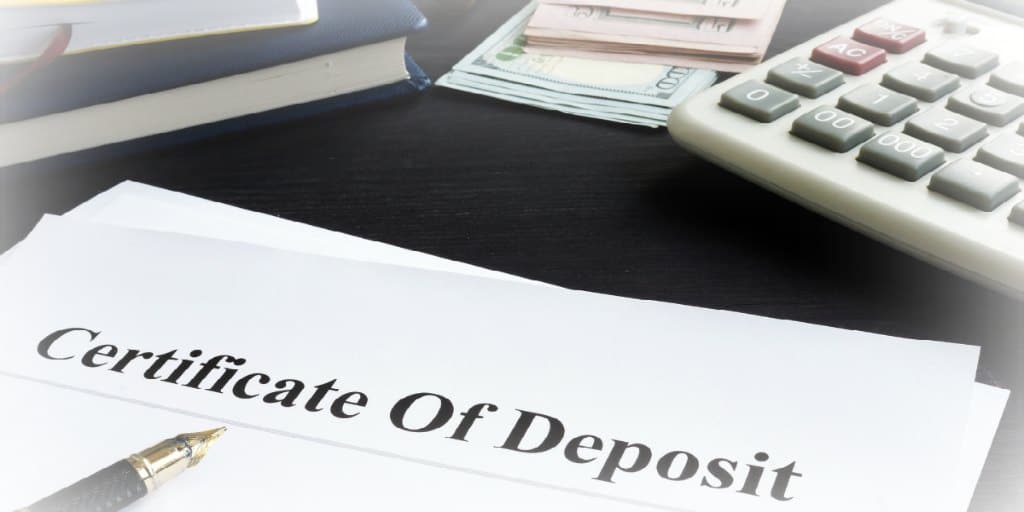

In the realm of personal finance, strategic planning is paramount, especially in times of economic flux. As the Federal Reserve pivots its focus towards potential rate cuts, investors are presented with a unique window of opportunity to leverage the advantages of certificates of deposit (CDs). In this blog post, we explore the mechanics of CDs, the current interest rate landscape, and the benefits of building a CD ladder as a savvy financial strategy.

Understanding Certificates of Deposit (CDs):

At their core, CDs offer a fixed-rate return on investment over a predetermined period, ranging from as short as one month to as long as twenty years. Unlike stocks and bonds, CD yields remain steady, providing investors with a predictable stream of income. Moreover, CDs are FDIC insured, offering a layer of security for deposited funds.

CDs are issued by banks, with interest rates influenced by various factors, including Federal Reserve policies and the duration of the CD. Typically, longer-term CDs command higher interest rates to compensate for the extended lock-up period.

Why Consider CDs Now?

In the current economic climate, where the Federal Reserve contemplates rate cuts, the allure of CDs becomes apparent. As the Fed’s focus shifts from raising to potentially lowering rates, investors stand to benefit from locking in today’s attractive CD yields before they diminish.

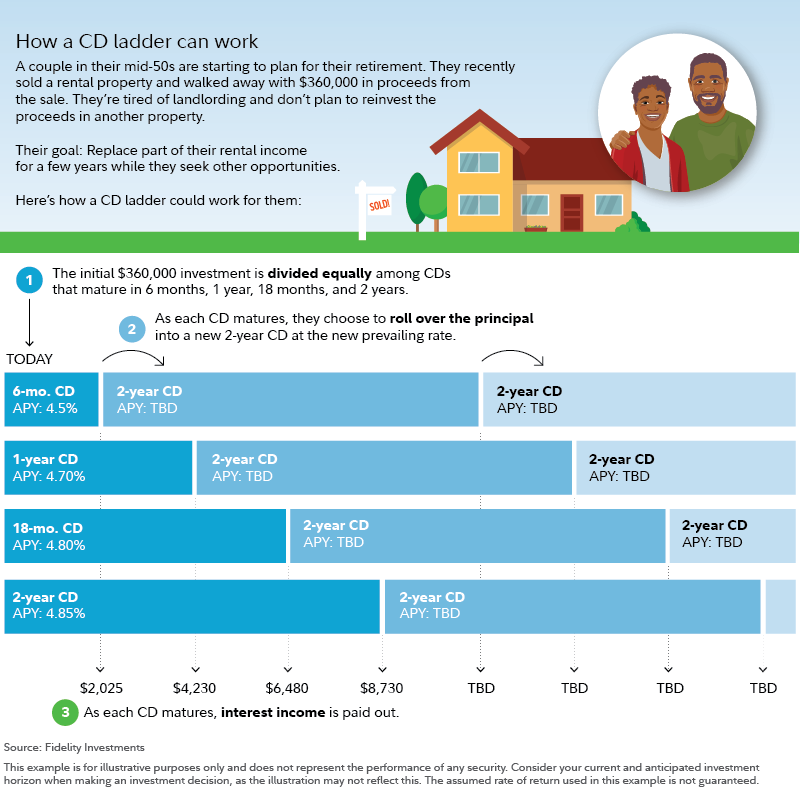

Building a CD ladder presents an effective strategy for maximizing returns while maintaining liquidity. A CD ladder consists of multiple CDs with staggered maturity dates, allowing investors to access funds periodically while capitalizing on higher yields offered by longer-term CDs.

Constructing a CD Ladder:

Building a CD ladder entails careful planning and execution. A typical ladder comprises CDs maturing at varying intervals, such as six months, one year, eighteen months, and two years. As each CD matures, investors have the flexibility to reinvest, withdraw funds, or extend the ladder by purchasing new CDs.

The beauty of a CD ladder lies in its adaptability to changing interest rate environments. If rates rise, investors benefit from higher yields as CDs mature and are reinvested at prevailing rates. Conversely, in a falling rate environment, investors can strategically position themselves by incorporating longer-maturity, higher-yielding CDs.

Considerations for CD Ladder Construction:

While CD ladders offer compelling benefits, investors must weigh several considerations before embarking on this strategy. Firstly, liquidity needs should be carefully assessed, as accessing funds before maturity may incur penalties. Additionally, market conditions and interest rate expectations should inform the selection of CD maturities to mitigate interest rate risk effectively.

Conclusion:

In conclusion, the current landscape of shifting interest rates presents a unique opportunity for investors to capitalize on the benefits of CDs, particularly through the implementation of a well-structured CD ladder. By strategically aligning investment objectives with prevailing market conditions, investors can navigate economic uncertainties while maximizing returns and preserving liquidity. As the Federal Reserve charts its course, proactive financial planning remains the cornerstone of long-term wealth accumulation.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/seizing-the-opportunity-building-a-cd-ladder-in-a-shifting-interest-rate-environment.html