In a world where financial literacy is increasingly recognized as a crucial life skill, introducing kids and teens to the world of investing can set them on a path to financial success. According to Fidelity’s 2023 Teens and Money Study, a staggering 91% of teens express a definite interest in investing, with three-quarters of them planning to embark on this financial journey before graduating college or earlier. So, can kids really invest in stocks, and if so, how can parents facilitate this process? Let’s delve into the details.

The Power of Early Investing

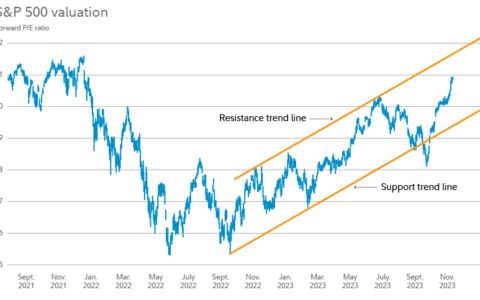

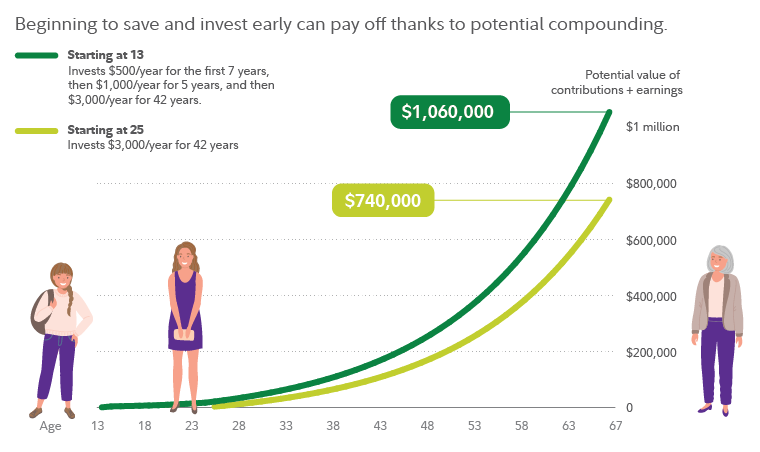

Time is the secret ingredient to potential investing success, thanks to the magic of compounding. Starting early allows for the gradual accumulation of wealth, with the potential for significant growth over the years. The earlier kids begin to save and invest, the less they may need to save in the long run. The power of compounding can work wonders, as demonstrated by a hypothetical scenario involving a saver who starts at age 13 versus one who begins at 25.

Fidelity Youth Account and App

Teens can take their first steps into the world of investing through the Fidelity Youth Account, available for those as young as 13. Unlike custodial accounts, this unique brokerage account is owned by the teen, allowing them to make all investment decisions. Paired with the Fidelity YouthTM app, teens gain the ability to manage their money, place trades, and access educational resources to enhance their financial literacy.

The app introduces innovative features like “money buckets,” enabling teens to organize their funds and automatically allocate a percentage toward specific goals. This digital version of envelope stuffing simplifies the savings process and instills disciplined financial habits. The Fidelity Youth app also offers a debit card with perks like 5 cents back per use and no ATM fees in the US, making it a comprehensive tool for teen investors.

Roth IRA for Kids

For a more long-term investment approach, the Fidelity Roth IRA for Kids provides a custodial account managed by an adult custodian until the child reaches a certain age. To contribute to this account, the child needs to have earned income, which can come from various sources, including household chores or part-time jobs. Contributions to the Roth IRA for Kids have the potential to grow tax-free, and withdrawals after age 59½ are also tax-free.

The account offers flexibility, allowing contributions to be withdrawn tax- and penalty-free at any time. While withdrawals of earnings before age 59½ may incur taxes and a 10% penalty, exceptions exist, such as penalty-free withdrawals for qualified higher education expenses or up to $10,000 for a first-time home purchase. Importantly, money saved in a Roth IRA for Kids is not considered a student-owned asset for financial aid purposes.

Exploring Other Savings Options

Beyond the Fidelity Youth Account and Roth IRA for Kids, there are additional ways to save for children’s future financial needs. 529 college savings plans, custodial accounts, and the ABLE account provide diverse options for parents looking to tailor their approach to their child’s unique circumstances.

By introducing kids to the world of investing early on and leveraging tools like the Fidelity Youth Account and Roth IRA for Kids, parents can empower the next generation with essential financial skills and set them on a path to enduring financial success. Investing isn’t just for adults—it’s a journey that kids can embark on to secure a brighter financial future.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/empowering-the-future-a-comprehensive-guide-on-kids-and-stock-investments.html