Introduction

India’s monsoon season is not just a meteorological phenomenon; it’s an economic event with far-reaching implications, particularly for the country’s gold market. While the connection between weather and gold prices may seem surprising at first, it’s a critical factor in understanding the dynamics of gold demand and its impact on the global market. In this blog post, we will delve into how India’s monsoon season affects gold prices and why it matters to investors and enthusiasts alike.

The Importance of India in the Gold Market

India is a powerhouse in the world of gold consumption, second only to China. What makes India unique in this context is that approximately 60% of the country’s gold demand comes from rural areas. Gold holds a special place in Indian culture and traditions, often seen as a symbol of prosperity and financial security. For many Indians, it’s not just a luxury item; it’s a form of savings.

The Monsoon Season and Agricultural Prosperity

The monsoon season in India typically runs from June to September, and it plays a pivotal role in the country’s agriculture. Approximately 70% of India’s annual rainfall, crucial for crops, reservoirs, and aquifers, is delivered during this season. A bountiful harvest resulting from a good monsoon season can have a direct impact on gold demand.

As Joe Cavatoni, a market strategist, points out, a good monsoon season can lead to strong economic outcomes for rural areas. Farmers, having reaped the rewards of a successful harvest, often use their surplus income to invest in gold. This historical trend of increased gold purchases in the late third to fourth quarter has a noticeable impact on global gold prices.

The Festival Season and Gold Buying

The end of the monsoon season also marks the beginning of the auspicious festival season in India. This period sees a surge in gold buying, not only for jewelry but also for coins and other forms of investment. These festivals, rooted in religion and culture, drive immediate physical demand for gold, a unique dynamic compared to other countries.

In addition to festivals, India’s peak wedding season from October to December further boosts gold demand. Weddings are grand affairs in India, and gold is an essential part of the bridal attire. Therefore, gold buying during this season is another significant driver of demand.

Jewelry Consumption as an Investment

Jewelry consumption is the largest source of Indian gold demand, with substantial purchases recorded in the first half of 2023. Will Rhind, CEO of GraniteShares, highlights that gold jewelry in India isn’t merely a fashion statement; it’s a means of wealth preservation. Many rural Indians lack access to traditional banking systems, so they turn to gold as a secure way to store their wealth.

Challenges to Gold Demand

Despite the positive impact of a good monsoon season, there are challenges that can dampen gold demand in India. One of these challenges is high gold prices denominated in rupees. When gold prices reach all-time highs, it becomes more challenging for consumers to maintain their previous buying pace. Consequently, consumer purchases may decrease or become more selective.

The World Gold Council’s second-quarter report shows that Indian gold jewelry consumption fell by 8% during the quarter due to record-high gold prices. However, a robust economic backdrop has supported demand, albeit at a lower level. Additionally, the Indian government’s decision to ban 2,000-rupee notes during the second quarter provided a short-term boost to gold demand.

The Role of Monetary Policy and Inflation

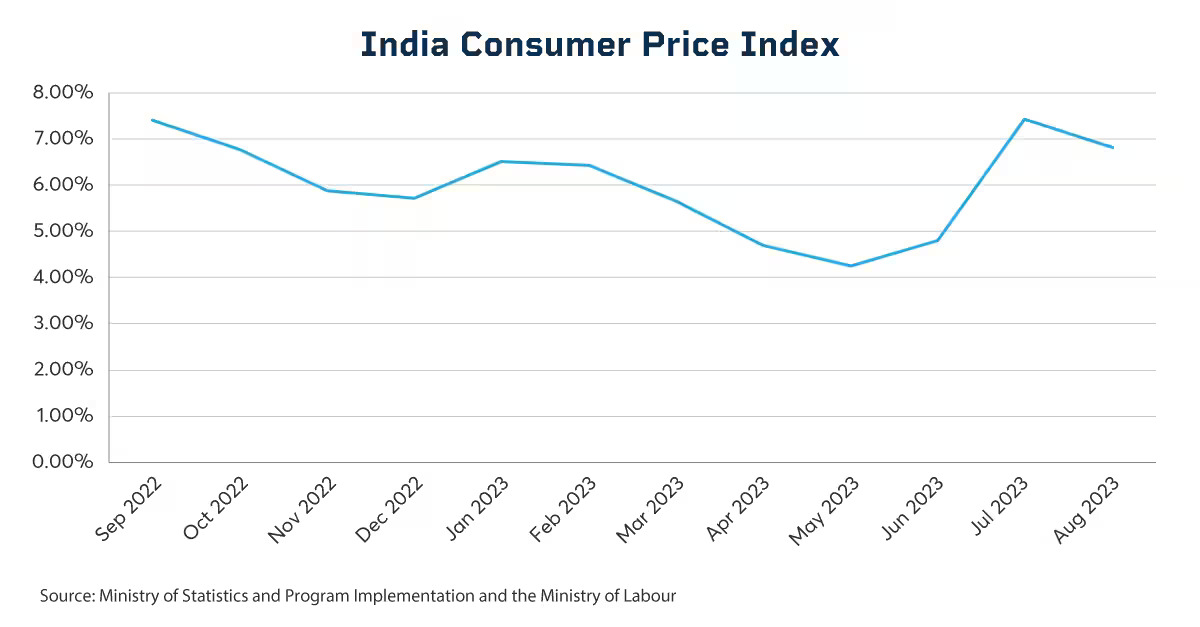

The Reserve Bank of India’s monetary policy also plays a significant role in influencing gold demand. Like central banks in Western countries, the RBI has raised interest rates to combat inflation. Inflation has a direct impact on consumer spending, including gold purchases. Therefore, Indian consumers are closely watching the RBI’s stance on interest rates, as any rate cuts could stimulate gold demand.

Furthermore, global monetary policy, especially that of the United States Federal Reserve, can affect investor interest in gold. Changes in interest rates and the overall direction of central banks can influence the price of gold, ultimately impacting consumption in India.

Conclusion

India’s monsoon season is far more than just a meteorological event—it’s a catalyst for change in the country’s gold market. A good monsoon season leads to prosperous agricultural yields, which, in turn, drives up gold demand. Combined with the festival season and wedding season, this period is a crucial driver of gold consumption in India.

However, challenges such as high gold prices and inflation can impact the level of demand. As investors and enthusiasts watch these dynamics unfold, they must consider not only the weather but also global economic factors and monetary policies that can influence India’s gold market and, subsequently, gold prices worldwide.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/monsoon-magic-analyzing-the-impact-of-indias-rainy-season-on-gold-prices.html