Introduction

The financial landscape is constantly shifting, and the next wave of stock market volatility may be closer than we think. Recent warnings from financial experts, including Goldman Sachs, have highlighted potential catalysts that could lead to a surge in market turbulence. In this blog post, we will delve into the factors contributing to this looming volatility and discuss strategies that investors can employ to navigate these uncertain times.

The Volatility Warning

Goldman Sachs, a prominent player in the financial world, has raised the alarm about an impending increase in stock market volatility. While markets have appeared relatively stable recently, it’s essential to recognize the concealed macro-risk factors that may be at play. Geopolitical risks, central banks’ efforts to combat inflation without triggering recessions, and the looming threat of a U.S. government shutdown are all elements that could spark significant market movements.

October Volatility Traditionally

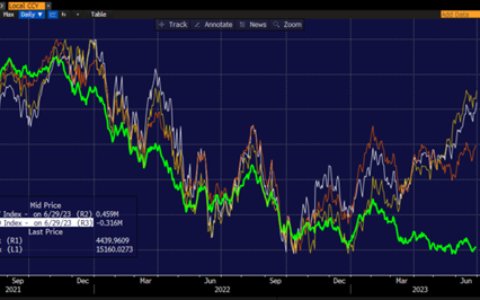

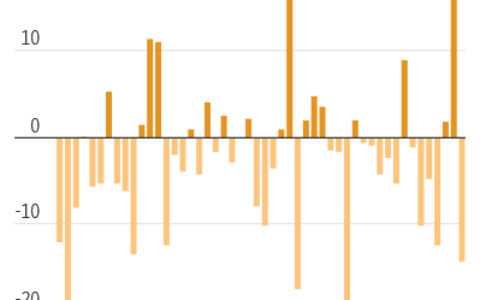

John Marshall, Goldman’s derivatives strategist, has pointed out a historical trend that adds weight to the concerns about increased volatility. He noted that options volatility for the S&P 500 index has historically spiked by an average of 27% from August to October over the past 95 years. Moreover, realized volatility in October has consistently been higher compared to other months, particularly for indexes like the Nasdaq 100, Russell 1000, and Russell 2000.

Marshall’s Strategy

In response to these observations, Marshall and his team at Goldman Sachs have advised clients to exercise caution, particularly when selling options. October, they argue, brings seasonal increases in volatility, coupled with a heavy corporate calendar for earnings reports and other financial updates. During this time, corporate management is under immense pressure to meet full-year earnings expectations, and investors managing money for others face the same time constraints.

Market Reaction in October

The historical data shows that shares and single stock options volumes have consistently peaked in October over the past 26 years. This trend has been especially pronounced in the last few years, particularly in the fourth quarter. Investor reactions during this month can be particularly fierce, with market volumes reflecting the heightened sensitivity of traders to corporate performance.

Investing in Volatility

To prepare for the anticipated market disruption, Marshall suggests considering the purchase of October call options on the Cboe Volatility Index (VIX). The VIX, often referred to as the “fear gauge,” tends to rise when the S&P 500 declines. By buying VIX call options, investors can hedge their portfolios against expected stock market weakness. These options are known for their amplified response to market movements, making them effective tools for managing risk.

Other experts, such as Alison Edwards of Susquehanna Financial Group, have also recommended “tail-risk hedging” with VIX options. These hedges can be cost-effective and offer substantial payoffs in the event of a market downturn.

The Future of Volatility

While portfolio hedging and VIX spikes are currently in the spotlight, Marshall anticipates that trading in individual stocks will regain favor as investors gain confidence that central banks are approaching the end of disruptive interest-rate increases. In this evolving financial landscape, staying informed and flexible in your investment approach will be key to navigating the potential waves of volatility that lie ahead.

Conclusion

The prospect of increased stock market volatility is a reminder that the financial landscape can change rapidly. Investors must be prepared for potential disruptions and consider strategies to safeguard their portfolios. Whether it’s through VIX call options, tail-risk hedging, or a more comprehensive risk management approach, staying proactive and adaptable in response to market dynamics will be crucial in the months ahead.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/preparing-for-the-storm-navigating-impending-stock-market-volatility.html