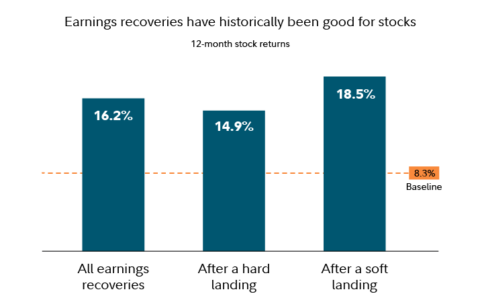

The ongoing economic dance between inflation, interest rates, and overall growth is one that continues to intrigue and, at times, perplex investors. Despite the swirling pressures of persistent inflation and elevated short-term interest rates, the economy stands robust and we remain hopeful that the Federal Reserve may manage to deliver the “soft landing” it aims to accomplish.

Reflections on Recurring Themes

Each quarter, we attempt to shed light on the market scenarios that shape our investment strategies. However, the second quarter of 2023 has largely been a mirror image of the trends observed since the previous fall. A healthy market for equities and high yield bonds persists, accompanied by consistent economic growth—albeit slower—and the gradual easing of inflationary pressures. The standout development has been the Federal Reserve’s decision to pause rate hikes in June, a move anticipated by market participants. The question now is—what’s next?

Given the significant correlation between equity and high yield markets, we believe it’s crucial to evaluate both to understand investors’ risk appetite. Year-to-date, the S&P 500 Index posted an impressive 16.9% return through June 30, 2023. Notably, much of this performance is attributable to the heavyweights in the index, previously dubbed the FAANG (Facebook, Apple, Amazon, Netflix, and Google), now expanded to include Microsoft and Tesla, and potentially Nvidia.

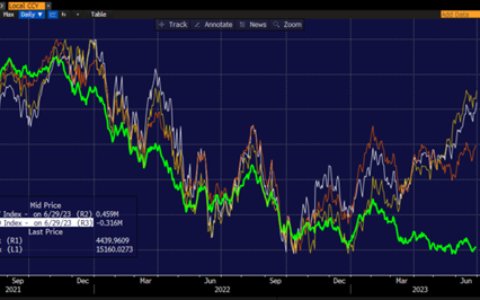

Dubbed as “MT. FAANG” in some circles, these tech giants—driven by stellar returns and heavy weightings—are making a big splash in the market cap-weighted S&P Index. However, it’s important to note that most active portfolio managers don’t follow the capitalization-based approach, but rather construct portfolios based on conviction levels. Given this, we propose that a better benchmark for these active managers would be the S&P 500 Equal Weight Index.

The Mega-Cap Conundrum

The divergence in performance between the two indices evokes memories of the late 1990s when not owning a handful of market-leading stocks almost assured underperformance. However, over the past three years, the equal weighted index has managed to eke out a slightly better performance. This disparity raises concern among market observers who fear a significant market risk if the MT. FAANG stocks underperform, especially if a recession is looming. A glance at history during the 2000-2003 period suggests that in such circumstances, the Equal Weight Index could fare better.

Deciphering Fed’s Moves and Inflation’s Trajectory

The June pause in the Fed’s tightening cycle stirs debate about whether it heralds a longer respite or simply a skip before further hikes. Future actions hinge on CPI and other economic data. Despite the enduring yield curve inversion, many investors expect a longer pause. However, the reality may be more complex. If we witness rising CPI inflation in the second half of 2023, the likelihood of the Fed reaching its 2% target this year seems low.

Three scenarios provide potential outcomes for year-end 2023 CPI. The first, albeit unlikely, assumes 0% inflation, leading to a year-over-year CPI of 2.87%. The second, assuming we return to the average monthly inflation from 2009 to 2019 (0.15%), suggests CPI would end the year at 3.79%. The third scenario, assuming the average post-Covid monthly inflation of 0.42%, predicts a year-end CPI reading of 5.47%. The likely reality, barring any exogenous shocks, falls somewhere between the second and third scenarios—well above the Fed’s 2% target.

Unraveling Employment Numbers

Employment is another key Fed consideration. Despite doom-saying predictions, non-farm payrolls continue to rise, and the unemployment rate remains at a cyclical low of 3.5%. While job openings are down from their peak in March 2022, they have climbed for the past three months, indicating a relatively healthy labor market.

Spotlight on the Consumer

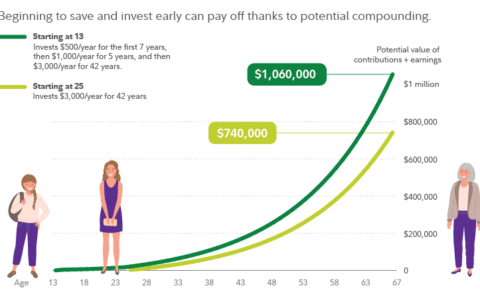

John Silvia from Dynamic Economic Strategy (DES) suggests that an effective measure of consumer health lies in their financials, particularly the financial obligation ratio. His observations reveal a statistically significant shift post-2007-2009, indicating that households have become more cautious about their indebtedness. The current ratio stands at 14.3%, significantly lower than the pre-Covid reading of 14.7% in Q4 2019, and well below the 17-18% seen before the 2008 financial crisis. Improvements in real disposable income and consumer sentiment are expected to support continued consumer spending and economic growth.

Charting the Course Forward

In this sea of economic calm, investors must remain vigilant of undercurrents that could upset the boat. While we cannot structure portfolios to shield against all possibilities, we can strike a balance between risk and reward. So far, markets seem to be navigating issues such as climate change and geopolitical tensions. We remain optimistic that barring unforeseen events, the U.S. economy will avoid a “hard landing” and likely experience slower growth, accompanied by higher inflation and interest rates than we’ve seen in the post-2008 era.

We continue to maintain a defensive stance with healthy levels of short-term assets, providing decent returns thanks to the inverted yield curve. We await periods of uncertainty where we can add longer-dated bonds with higher yields to our portfolios. Our focus remains steadfast on finding these opportunities and guiding your investments through these interesting times.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/navigating-calm-seas-amidst-undercurrents-the-third-quarter-strategic-income-outlook.html

Comments(1)

Navigating Forward: In Calm or Storm

As we enter the third quarter of 2023, we find ourselves navigating economic waters that, while seemingly calm, are marked by hidden currents of risk. The omnipresent forces of inflation and interest rates continue to shape our journey, while the looming shadow of a potential slowdown in the MT. FAANG stocks reminds us of the need for caution and diversification.

Yet, despite these uncertainties, there are reasons for cautious optimism. Indicators like the steady employment rate and healthy consumer financials give us hope that the U.S. economy will continue to demonstrate resilience and maintain its course of growth. The expected moderation of inflation in the latter half of the year, albeit above the Fed’s target, further bolsters this outlook.

In these complex times, our commitment to strategic investment remains unwavering. We will continue to diligently analyze evolving market conditions, balance risk and reward, and seize opportunities to add value to your portfolio. While the seas of investment may ebb and flow, our compass remains firmly set on the North Star of capital preservation and consistent returns.

To navigate the tranquil or turbulent tides of the investment world, it is essential to remain informed, flexible, and above all, patient. We appreciate your continued trust in us and look forward to sharing this journey with you. Here’s to forging ahead and steering towards a future of growth and prosperity.