Introduction:

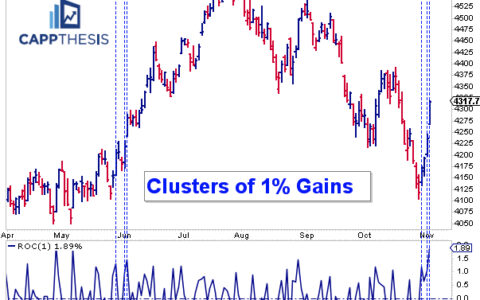

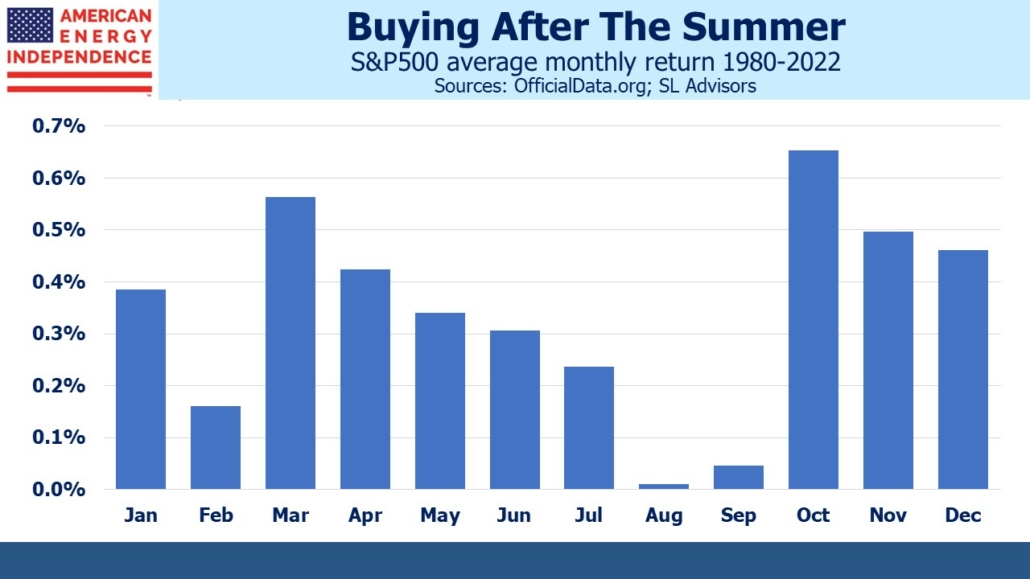

Seasonal patterns in the stock market have long fascinated investors and analysts. September, in particular, is infamous for being seasonally the worst month of the year. However, before we jump to conclusions and expect another market crash akin to 1929 or 1987, it’s essential to analyze the broader context and understand whether historical patterns will hold true this time around.

The Fourth Quarter Historical Returns:

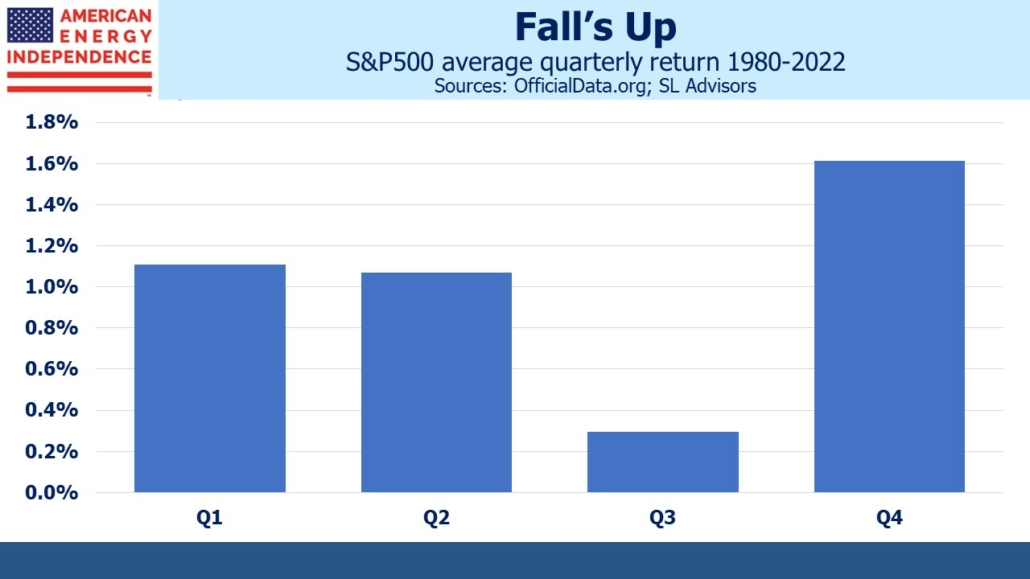

While September may be notorious for market woes, the fourth quarter historically offers the best returns. However, it’s crucial not to get caught up in meaningless relationships with seasonal patterns, as not all falls will follow the same script. One significant trend to note is that the best-performing quarter typically follows the seasonally weakest third quarter. For example, since 1980, the average return for the fourth quarter has been 1.6%, following a seasonally weak third quarter with a mere 0.3% return. This relationship has persisted for over a century.

Changing Dynamics in MLPs:

Master Limited Partnerships (MLPs) used to have a distinct quarterly seasonal pattern around distribution dates. Investors in MLPs often seek yield-driven investments due to quarterly payments, and the complexities of K-1 tax forms have induced sales before year-end and purchases right after to avoid K-1 filings for just a few weeks of January. However, with fewer MLPs available today, these seasonals have become less pronounced, presenting challenges for Alerian-linked products.

Macro Factors at Play:

To understand whether the approaching fourth quarter will align with historical patterns, we need to consider the macroeconomic factors currently influencing the market.

- Interest Rates and the Fed: The Federal Reserve’s role in managing interest rates has evolved, and there’s less worry about it causing a recession. With the economy handling a 4.5% ten-year treasury yield, the concern now is whether rates will remain higher for an extended period.

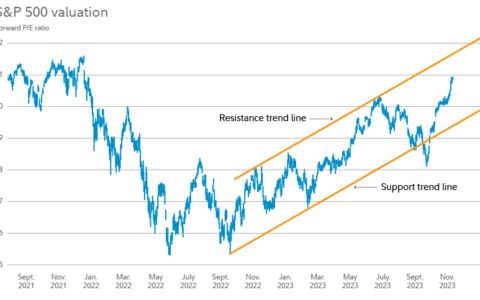

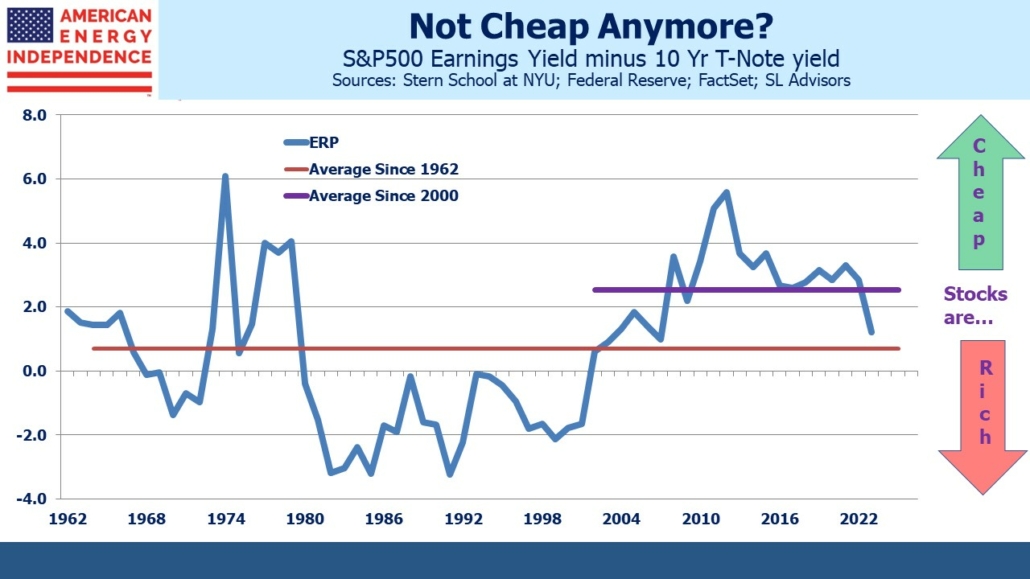

- Equity Risk Premium (ERP): The Equity Risk Premium indicates that stocks are expensive compared to the past couple of decades but are around neutral when looking back to 1960. This suggests that market valuations are in a delicate balance.

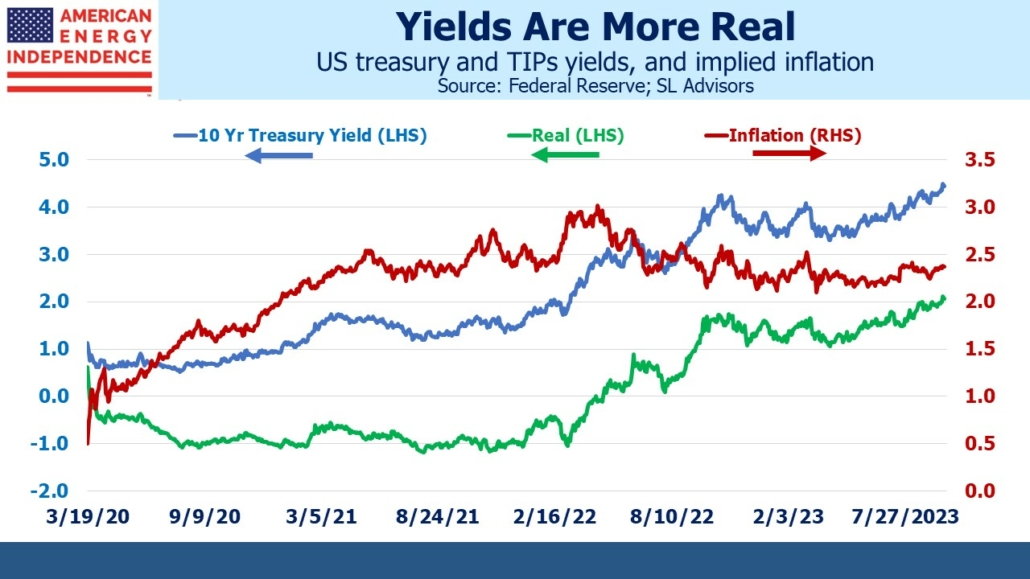

- Bond Market: Bond yields are rising alongside inflation expectations, while real yields have moved from negative territory to over 2%. Bonds are becoming a more attractive investment, though they may still not fully compensate for the concerning fiscal outlook.

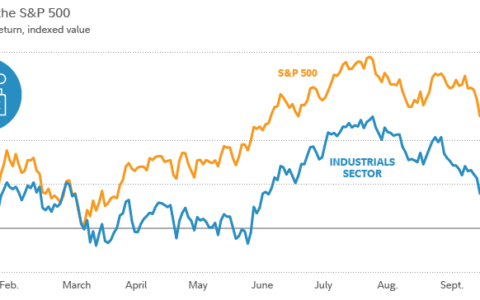

- Crude Oil Prices: Crude oil prices are steadily increasing, raising concerns about the impact on consumers’ disposable income. However, higher oil prices could support the transition to electric vehicles and the energy sector’s growth.

- Energy Sector Performance: Companies like Occidental (OXY) report no evidence of demand destruction in response to rising oil prices, and there’s a positive outlook for the energy sector.

Conclusion:

As we navigate the upcoming months, it’s essential to recognize that historical patterns are not foolproof indicators of future market performance. While September might traditionally be a challenging month, the fourth quarter often brings better returns. This year’s market dynamics, including rising interest rates and oil prices, are “known knowns” that could impact the market.

Investors should remain cautious, stay informed about current market conditions, and consider diversifying their portfolios to mitigate risks. It’s also worth noting that the changing landscape of MLPs and the potential impact on related indices and investment products could further influence market dynamics.

In conclusion, while seasonality can offer valuable insights, it’s essential to blend historical patterns with a deep understanding of the current economic and geopolitical factors to make informed investment decisions.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/navigating-fall-seasonals-will-market-dynamics-defy-septembers-history.html