The amount of government debt held by the United States continues to rise, with the annual interest rate payment on that debt reaching a staggering $850 billion and counting. This figure represents a significant portion of the federal budget and is a cause for concern for many economists and policymakers. The rapid rise in the interest rate payment on government debt is not only a reflection of the growing debt itself, but also of the increasing cost of borrowing money in the current economic climate.

One of the main factors contributing to the rise in the interest rate payment on government debt is the Federal Reserve’s monetary policy. In recent years, the Fed has taken steps to keep interest rates low in order to stimulate economic growth. However, as the economy has improved, the Fed has begun to raise interest rates, which has led to an increase in the cost of borrowing money. As a result, the interest rate payment on government debt has risen, putting a strain on the federal budget.

Another factor contributing to the rise in the interest rate payment on government debt is the declining value of the dollar. The dollar has lost value relative to other currencies in recent years, making it more expensive for the government to repay its debts. This has added to the cost of the interest rate payment on government debt, putting further pressure on the federal budget.

The rise in the interest rate payment on government debt has implications for the economy as a whole. For one thing, it means that there is less money available for other important programs, such as education, infrastructure, and defense. Additionally, the high cost of borrowing money can slow down economic growth, as businesses and consumers are less likely to borrow and invest when interest rates are high.

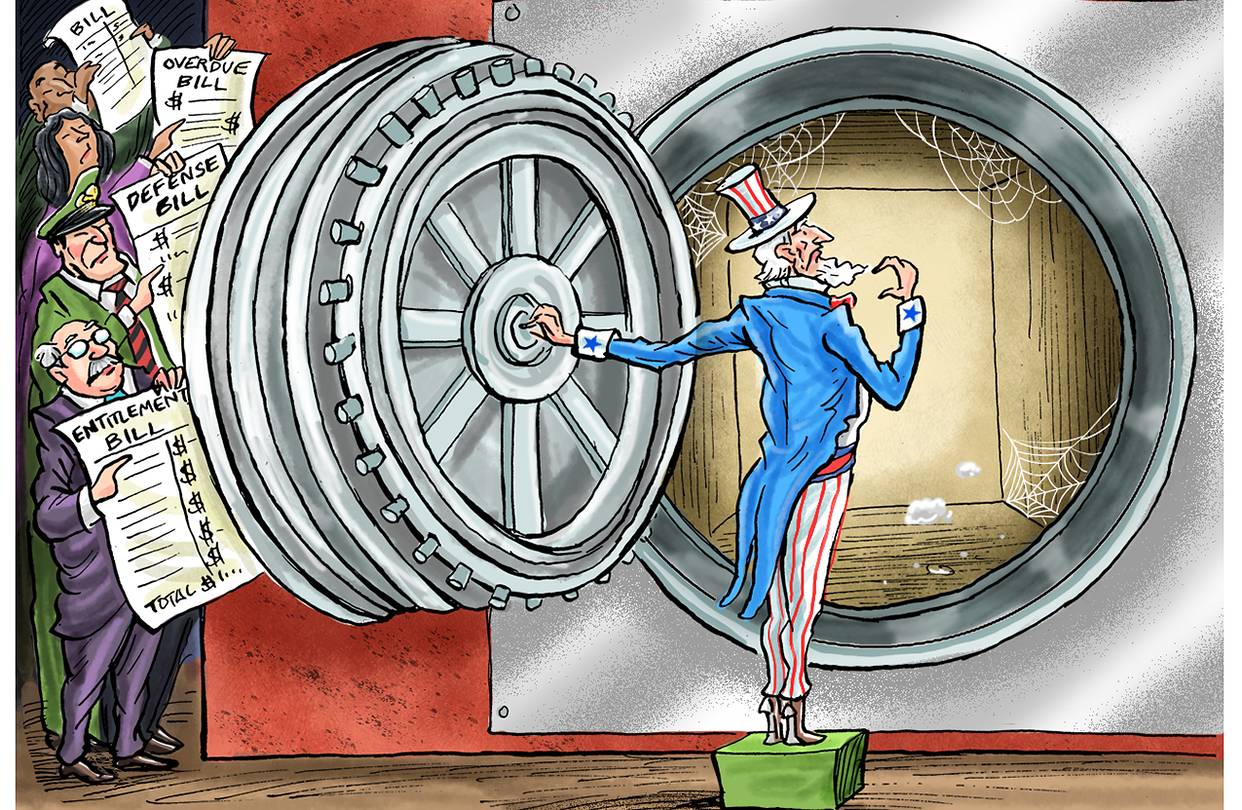

It’s important to note that the interest rate payment on government debt is not the only financial obligation that the government faces. The federal government also has other obligations, such as Social Security, Medicare, and Medicaid, that require large amounts of funding. These programs, along with the rising interest rate payment on government debt, are putting a strain on the federal budget and creating a long-term fiscal challenge for the country.

There are a number of steps that policymakers could take to address the rising interest rate payment on government debt. For example, they could reduce spending in other areas of the federal budget, such as defense or entitlements, in order to free up funds to pay for the interest on the debt. They could also consider raising taxes, which would increase the amount of revenue available to pay the interest on the debt.

Another option is to pursue economic growth strategies that would increase the size of the economy and thereby increase tax revenue. This would make it easier to pay the interest on the debt and reduce the burden on the federal budget. Some economists argue that reducing regulations and implementing pro-growth policies, such as tax cuts, would help to stimulate economic growth and boost tax revenue.

It’s also worth considering the role of the Federal Reserve in the rising interest rate payment on government debt. Some experts argue that the Fed should take steps to keep interest rates low, as this would help to reduce the cost of borrowing money and make it easier for the government to repay its debts. However, others argue that the Fed should raise interest rates to keep inflation in check, which would help to preserve the value of the dollar and reduce the long-term fiscal challenges faced by the government.

In conclusion, the rise in the interest rate payment on government debt is a cause for concern for many economists and policymakers. With the federal budget under pressure from other obligations, such as Social Security and Medicare, finding a way to address this issue is critical for the long-term fiscal health of the country. Policymakers must consider a range of options, from reducing spending and raising taxes to promoting economic growth and adjusting monetary policy, to address this issue in a responsible and effective manner. Ultimately, finding a solution to the rising interest rate payment on government debt will require a combination of political will and sound economic policy.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/the-implications-and-options-for-addressing-the-rising-interest-rate-payment-on-us-government-debt.html