Introduction:

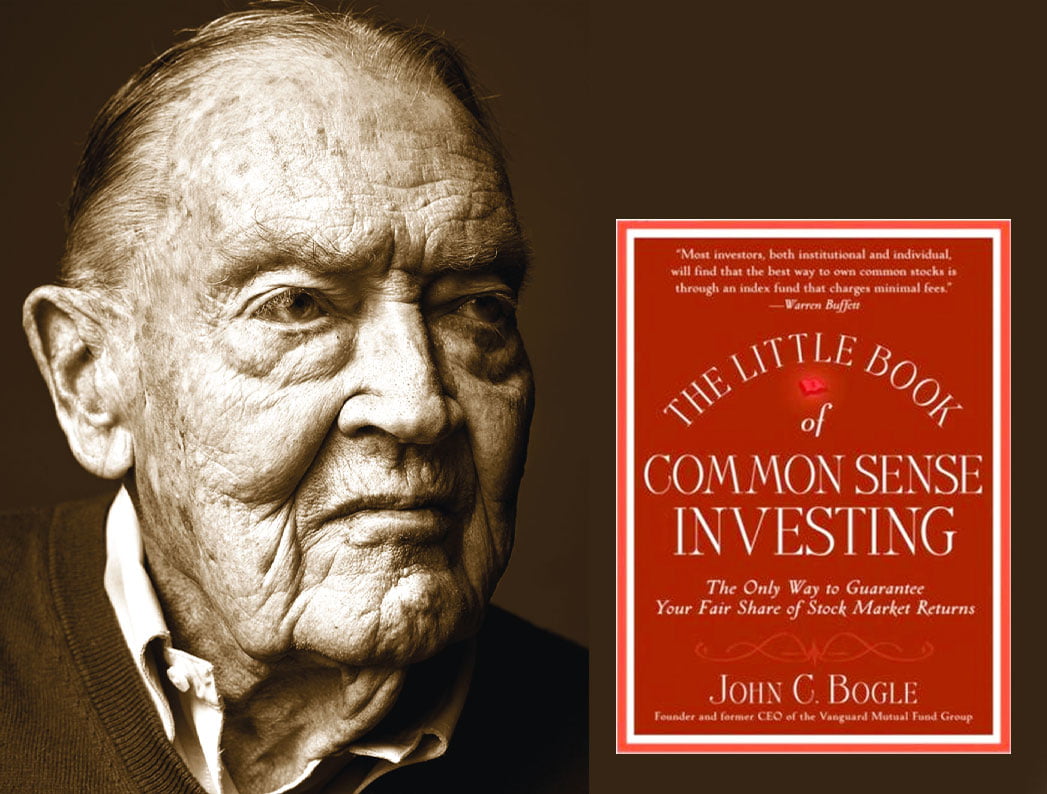

“The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns (Little Books, Big Profits)” (buy the book) by John C. Bogle is a classic investment guide that has stood the test of time, offering readers a simple yet powerful approach to building wealth. Bogle, the founder of The Vanguard Group and the creator of the first index fund, presents a compelling case for low-cost, passive investing as the key to long-term financial success. In this review, we’ll explore the main takeaways from Bogle’s book and discuss its continued relevance and impact on investors.

- The Case for Index Investing:

At the core of Bogle’s investment philosophy is the belief that low-cost index funds outperform actively managed funds in the long run. He presents a wealth of data and research to support this claim, demonstrating that the vast majority of actively managed funds fail to consistently beat their benchmark indexes. By investing in a low-cost index fund, Bogle argues that investors can capture the market’s returns while minimizing fees and expenses.

- Costs Matter:

One of the central themes of “The Little Book of Common Sense Investing” is the importance of minimizing investment costs. Bogle explains that high fees and expenses can significantly erode an investor’s returns over time, making it all the more challenging to achieve long-term financial goals. By choosing low-cost index funds, investors can keep more of their returns and let the power of compounding work in their favor.

- The Folly of Market Timing:

Bogle cautions against the temptation to time the market, as even the most seasoned professionals struggle to predict its short-term movements accurately. Instead, he advocates for a buy-and-hold strategy, emphasizing the importance of staying invested through market ups and downs to maximize long-term returns. This approach encourages discipline, patience, and a long-term perspective, which are crucial to investment success.

- Diversification:

“The Little Book of Common Sense Investing” also highlights the importance of diversification in building a robust investment portfolio. Bogle recommends investing in broadly diversified index funds that provide exposure to a wide range of asset classes, sectors, and geographical regions. This strategy can help investors minimize risk while still capturing the market’s overall returns.

- The Power of Compounding:

Bogle emphasizes the power of compounding, explaining that even small differences in returns can have a significant impact on an investor’s wealth over time. By minimizing costs and staying invested in a diversified portfolio of low-cost index funds, investors can harness the power of compounding to grow their wealth and achieve their financial goals.

- Simplicity:

A key tenet of Bogle’s investment philosophy is the importance of simplicity. He encourages investors to avoid the noise and complexity of the financial industry and focus on a straightforward, low-cost investment strategy. By keeping things simple, investors can reduce the potential for mistakes and make it easier to stay disciplined and focused on their long-term objectives.

- Rebalancing:

Bogle discusses the importance of periodically rebalancing one’s portfolio to maintain the desired level of risk and diversification. By doing so, investors can ensure that their portfolio remains aligned with their long-term goals and risk tolerance, even as market conditions change.

Conclusion:

“The Little Book of Common Sense Investing” by John C. Bogle remains a timeless and invaluable resource for investors seeking a proven, straightforward approach to building wealth. Bogle’s emphasis on low-cost index funds, diversification, and a long-term perspective provides a powerful framework for achieving financial success. By following the principles outlined in this book, investors can simplify their investment strategy, minimize costs, and maximize their potential for long-term growth. Whether you’re a beginner or an experienced investor, Bogle’s wisdom and insights continue to resonate and offer valuable guidance in today’s complex financial landscape.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/the-little-book-of-common-sense-investing-book-review.html