Will the US Ever Default on Its Debt?

In the US, debt is becoming an increasingly common topic of conversation. The federal government’s debt has grown to more than $31 trillion and shows no sign of slowing down. This raises a critical question: will the US ever default on its debt? In this article, we’ll look at what exactly it would take for the US to actually default on its debt and examine how likely that scenario is. We’ll also discuss some of the consequences that could come with such a move and highlight some potential solutions to help prevent it from happening.

What is US Debt Ceiling?

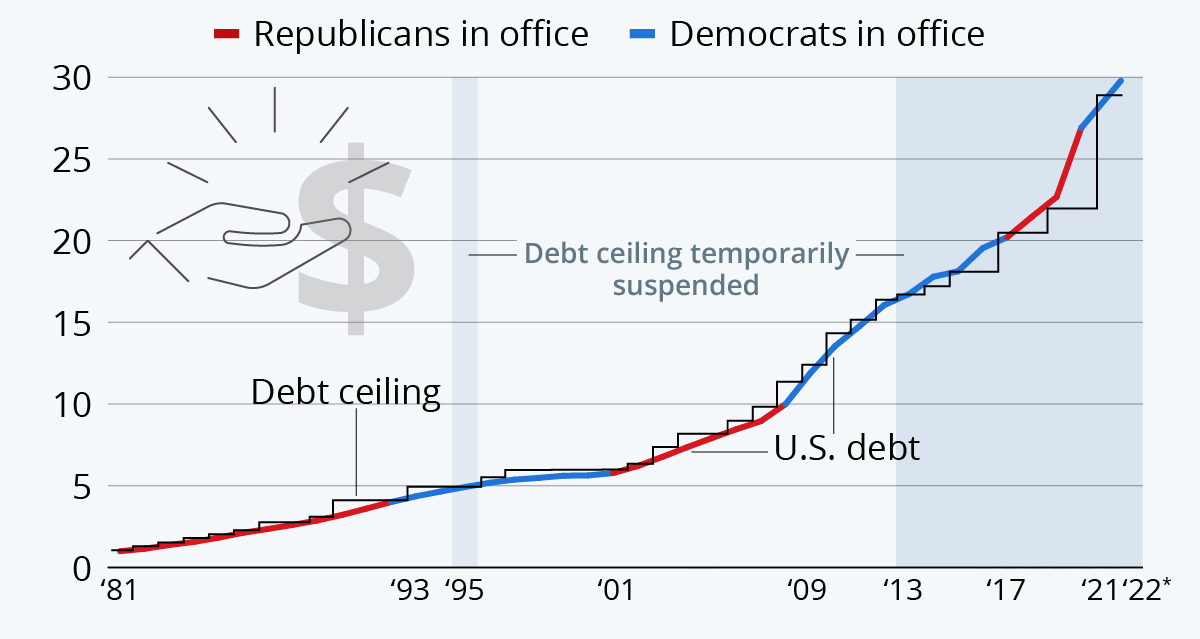

In the United States, the debt ceiling is the legal limit on the amount of national debt that can be issued by the U.S. Treasury. The debt ceiling was established in 1917 when Congress passed the Second Liberty Bond Act. Since then, Congress has periodically raised the debt ceiling to accommodate the country’s growing debt. As of 2019, the national debt is about $22 trillion and counting, so lawmakers will need to raise the debt ceiling again soon.

Some people believe that defaulting on the national debt would be catastrophic for the economy, but it’s actually quite unlikely. For one thing, there’s always been political will to avoid default; it would be a very unpopular move with voters. Moreover, even if the U.S. did default on its debt, it would still have enough revenue coming in from taxes to make interest payments on its debts (which is all that would be required to avoid technical default). So while a default might cause some short-term economic turmoil, it’s not likely to lead to long-term damage.

Recent Debt Ceiling History

The United States has a long history of debt ceiling crises. In fact, since 1960, Congress has raised the debt ceiling 74 times.

Here’s a look at some of the most recent debt ceiling crises:

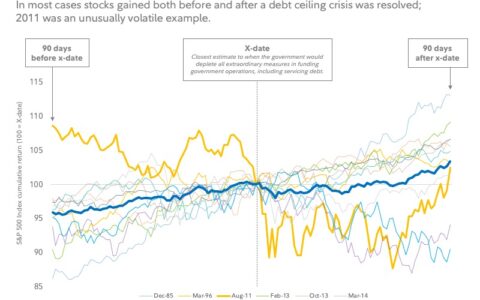

2011: Congress debates raising the debt ceiling to avoid default. In the end, they reach a deal to raise the debt ceiling and avoid default.

2013: Another debate over raising the debt ceiling leads to a government shutdown. Congress eventually raises the debt ceiling and ends the shutdown.

2015: Congress reaches a deal to raise the debt ceiling and avoid default once again.

2017: The current administration indicates that it may not want to raise the debt ceiling, leading to concerns about another potential crisis.

A list of recent debt ceiling increasing:

- January 2013: The debt ceiling was raised to $16.699 trillion.

- February 2014: The debt ceiling was raised to $17.2 trillion.

- March 2015: The debt ceiling was raised to $18.1 trillion.

- November 2015: The debt ceiling was raised to $19.8 trillion.

- March 2017: The debt ceiling was raised to $20.5 trillion.

- February 2018: The debt ceiling was raised to $21.2 trillion.

- October 2018: The debt ceiling was raised to $22 trillion.

- July 2021: The debt ceiling was raised to $28.5 trillion.

- October 2021: The debt ceiling was raised to $28.9 trillion.

- December 2021: The debt ceiling was raised to $31.4 trillion.

Two Ways the U.S. Could Default on Its Debt

A) Failing To Raise or Suspend the Debt Ceiling:

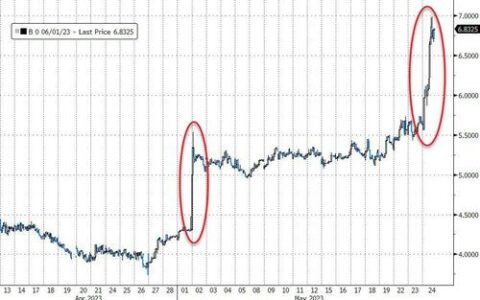

If Congress fails to raise the debt ceiling, the US government will be unable to borrow any more money and will be forced to default on its debt. This could have catastrophic consequences for the US economy, as it would likely lead to a sharp increase in interest rates and a decrease in investor confidence.

When the debt ceiling is reached, the Treasury Department takes various emergency financial measures to help pay the nation’s bills, buying some time for Congress to make a decision on the debt ceiling.

B) Not Paying Interest on Treasury Bonds:

If the US government decides not to pay interest on its treasury bonds, this would technically be considered a default. However, it is unlikely that this would actually happen, as it would cause an enormous amount of damage to the US economy and would likely lead to even higher interest rates.

How a U.S. Debt Default Could Impact the Economy

A default on U.S. debt could have a number of impacts on the economy, both in the short and long run. In the short run, it could lead to higher interest rates and decreased confidence in the U.S. economy. This could lead to a decrease in investment and spending, which would in turn lead to slower economic growth. In the long run, a default could also lead to inflation, as the government would likely print more money to make up for the shortfall in revenue. This could erode the value of savings and make it difficult for businesses to plan for the future.

How a U.S. Debt Default Could Impact the Market: Stocks and Bonds

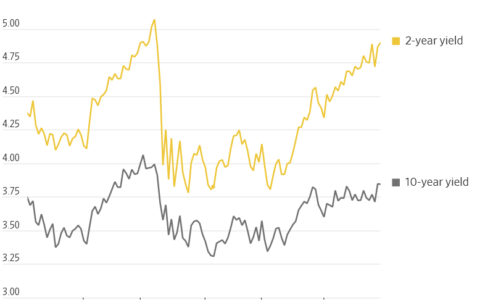

A default on U.S. debt would have major implications for the stock and bond markets. For one, it would likely lead to a sharp decline in the value of both stocks and bonds. This is because investors would view a default as a sign that the U.S. is not able to meet its financial obligations, which would make them less likely to invest in U.S.-based assets.

In addition, a U.S. debt default would also trigger a rise in interest rates. This is because the U.S. government would no longer be able to borrow money at low interest rates, which means that other borrowers (including companies and consumers) would have to pay more to borrow money. This could lead to slower economic growth and higher inflation, which would further impact the stock and bond markets negatively.

How Can the US Avoid Defaulting on Its Debt in the Future?

There are a few ways that the United States can avoid defaulting on its debt in the future. One way is for the government to raise taxes. Another way is for the government to cut spending.

The government could also try to negotiate with creditors to get more time to pay off the debt or to reduce the amount that is owed. However, it is important to remember that the United States has never defaulted on its debt before and is unlikely to do so in the future.

Conclusion

In conclusion, the risk of a US debt default is currently low and unlikely. This is due to the fact that many of the factors leading up to previous defaults are not present in today’s financial climate. Regardless, it is important for policy makers and citizens alike to stay vigilant when it comes to managing public finances and working together towards a more financially secure future.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/the-possibility-of-us-default-on-its-debt-treasury-bonds.html