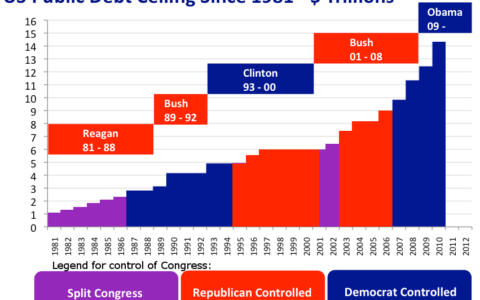

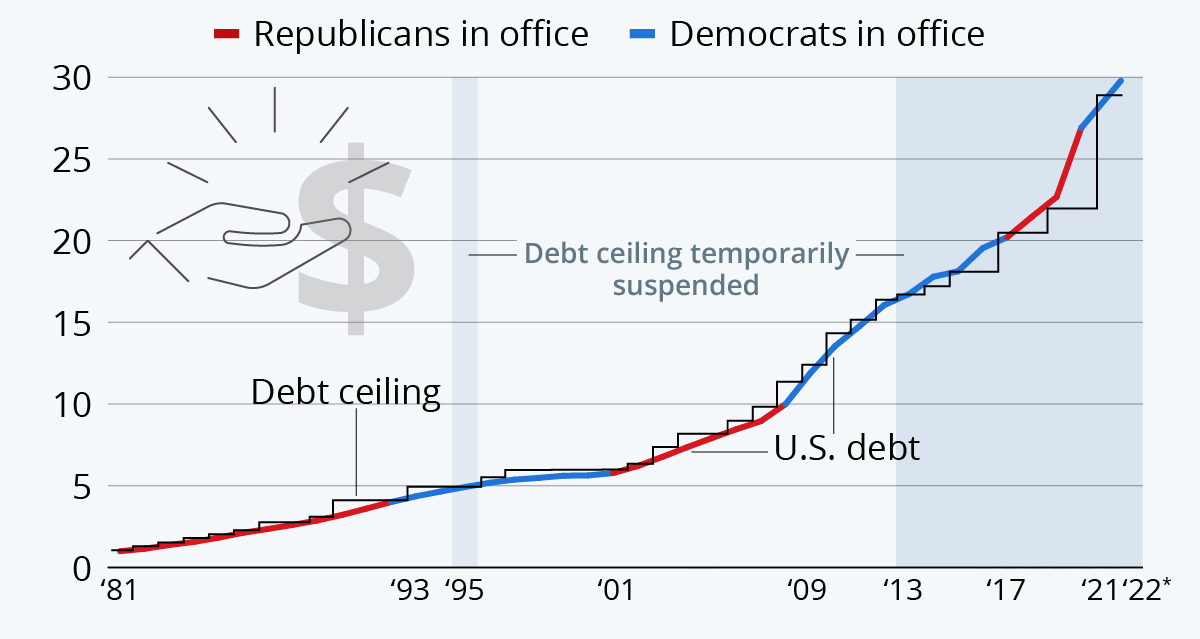

The history of the United States debt ceiling deals with movements in the United States debt ceiling since it was created in 1917. Management of the United States public debt is an important part of the macroeconomics of the United States economy and finance system, and the debt ceiling is a limitation on the federal government’s ability to manage the economy and finance system. The debt ceiling is also a limitation on the federal government’s ability to finance government operations, and the failure of Congress to authorise an increase in the debt ceiling has resulted in crises, especially in recent years.

A statutorily imposed debt ceiling has been in effect since 1917 when the US Congress passed the Second Liberty Bond Act. Before 1917 there was no debt ceiling in force, but there were parliamentary procedural limitations on the amount of debt that could be issued by the government.

Except for about a year during 1835–1836, the United States has continuously had a fluctuating public debt since the US Constitution legally went into effect on March 4, 1789. Debts incurred during the American Revolutionary War and under the Articles of Confederation led to the first yearly report on the amount of the debt ($75,463,476.52 on January 1, 1791). The national debt, as expressed in absolute dollars, has increased under every presidential administration since Herbert Hoover.

| Table of historical debt ceiling levels | |||

|---|---|---|---|

| Date | Debt Ceiling (billions of dollars) |

Change in Debt Ceiling (billions of dollars) |

Statute |

| June 25, 1940 | 49 | ||

| February 19, 1941 | 65 | +16 | |

| March 28, 1942 | 125 | +60 | |

| April 11, 1943 | 210 | +85 | |

| June 9, 1944 | 260 | +50 | |

| April 3, 1945 | 300 | +40 | |

| June 26, 1946 | 275 | −25 | |

| August 28, 1954 | 281 | +6 | |

| July 9, 1956 | 275 | −6 | |

| February 26, 1958 | 280 | +5 | |

| September 2, 1958 | 288 | +8 | |

| June 30, 1959 | 295 | +7 | |

| June 30, 1960 | 293 | −2 | |

| June 30, 1961 | 298 | +5 | |

| July 1, 1962 | 308 | +10 | |

| March 31, 1963 | 305 | −3 | |

| June 25, 1963 | 300 | −5 | |

| June 30, 1963 | 307 | +7 | |

| August 31, 1963 | 309 | +2 | |

| November 26, 1963 | 315 | +6 | |

| June 29, 1964 | 324 | +9 | |

| June 24, 1965 | 328 | +4 | |

| June 24, 1966 | 330 | +2 | |

| March 2, 1967 | 336 | +6 | |

| June 30, 1967 | 358 | +22 | |

| June 1, 1968 | 365 | +7 | |

| April 7, 1969 | 377 | +12 | |

| June 30, 1970 | 395 | +18 | |

| March 17, 1971 | 430 | +35 | |

| March 15, 1972 | 450 | +20 | |

| October 27, 1972 | 465 | +15 | |

| June 30, 1974 | 495 | +30 | |

| February 19, 1975 | 577 | +82 | |

| November 14, 1975 | 595 | +18 | |

| March 15, 1976 | 627 | +32 | |

| June 30, 1976 | 636 | +9 | |

| September 30, 1976 | 682 | +46 | |

| April 1, 1977 | 700 | +18 | |

| October 4, 1977 | 752 | +52 | |

| August 3, 1978 | 798 | +46 | |

| April 2, 1979 | 830 | +32 | |

| September 29, 1979 | 879 | +49 | |

| June 28, 1980 | 925 | +46 | |

| December 19, 1980 | 935 | +10 | |

| February 7, 1981 | 985 | +50 | |

| September 30, 1981 | 1,079 | +94 | |

| June 28, 1982 | 1,143 | +64 | |

| September 30, 1982 | 1,290 | +147 | |

| May 26, 1983 | 1,389 | +99 | Pub. L. 98–34 |

| November 21, 1983 | 1,490 | +101 | Pub. L. 98–161 |

| May 25, 1984 | 1,520 | +30 | |

| June 6, 1984 | 1,573 | +53 | Pub. L. 98–342 |

| October 13, 1984 | 1,823 | +250 | Pub. L. 98–475 |

| November 14, 1985 | 1,904 | +81 | |

| December 12, 1985 | 2,079 | +175 | Pub. L. 99–177 |

| August 21, 1986 | 2,111 | +32 | Pub. L. 99–384 |

| October 21, 1986 | 2,300 | +189 | |

| May 15, 1987 | 2,320 | +20 | |

| August 10, 1987 | 2,352 | +32 | |

| September 29, 1987 | 2,800 | +448 | Pub. L. 100–119 |

| August 7, 1989 | 2,870 | +70 | |

| November 8, 1989 | 3,123 | +253 | Pub. L. 101–140 |

| August 9, 1990 | 3,195 | +72 | |

| October 28, 1990 | 3,230 | +35 | |

| November 5, 1990 | 4,145 | +915 | Pub. L. 101–508 |

| April 6, 1993 | 4,370 | +225 | |

| August 10, 1993 | 4,900 | +530 | Pub. L. 103–66 |

| March 29, 1996 | 5,500 | +600 | Pub. L. 104–121 (text) (PDF) |

| August 5, 1997 | 5,950 | +450 | Pub. L. 105–33 (text) (PDF) |

| June 11, 2002 | 6,400 | +450 | Pub. L. 107–199 (text) (PDF) |

| May 27, 2003 | 7,384 | +984 | Pub. L. 108–24 (text) (PDF) |

| November 16, 2004 | 8,184 | +800 | Pub. L. 108–415 (text) (PDF) |

| March 20, 2006 | 8,965 | +781 | Pub. L. 109–182 (text) (PDF) |

| September 29, 2007 | 9,815 | +850 | Pub. L. 110–91 (text) (PDF) |

| June 5, 2008 | 10,615 | +800 | Pub. L. 110–289 (text) (PDF) |

| October 3, 2008 | 11,315 | +700 | Pub. L. 110–343 (text) (PDF) |

| February 17, 2009 | 12,104 | +789 | Pub. L. 111–5 (text) (PDF) |

| December 24, 2009 | 12,394 | +290 | Pub. L. 111–123 (text) (PDF) |

| February 12, 2010 | 14,294 | +1,900 | Pub. L. 111–139 (text) (PDF) |

| January 30, 2012 | 16,394 | +2,100 | Pub. L. 112–25 (text) (PDF) |

| February 4, 2013 | Suspended | ||

| May 19, 2013 | 16,699 | +305 | Pub. L. 113–3 (text) (PDF) |

| October 17, 2013 | Suspended | ||

| February 7, 2014 | 17,212 and auto-adjust |

+213 | Pub. L. 113–83 (text) (PDF) |

| March 15, 2015 | 18,113 End of auto adjust |

+901 | Pub. L. 113–83 (text) (PDF) |

| October 30, 2015 | Suspended | Pub. L. 114–74 (text) (PDF) | |

| March 15, 2017 | 19,847 | +1,734 | |

| September 30, 2017 | Suspended | Pub. L. 115–56 (text) (PDF)Pub. L. 115–123 (text) (PDF) | |

| March 1, 2019 | 22,030 | +2,183 | |

| August 2, 2019 | Suspended | Pub. L. 116–37 (text) (PDF) | |

| July 31, 2021 | 28,500 | +6,470 | |

| October 14, 2021 | 28,900 | +480 | Pub. L. 117–50 (text) (PDF) |

| December 16, 2021 | 31,400 | +2,500 | Pub. L. 117–73 (text) (PDF) |

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/us-historical-debt-ceiling-from-1917.html