Navigating the world of dental insurance can be a daunting task, with many factors contributing to the ideal plan. Fortunately, J.D. Power’s 2023 U.S. Dental Plan Satisfaction Study offers valuable insights into this field. According to the study, Aetna Dental has claimed the top spot in customer satisfaction rankings among insurers offering dental coverage.

There’s good news for consumers as well. In 2023, dental insurance plans as a whole have seen a marked increase in customer satisfaction. On the study’s 1,000-point scale, the average overall customer satisfaction score for 2023 was 782, which represented a significant leap of 18 points compared to the previous year.

This is a significant turnaround from the previous trend. In 2022, the customer satisfaction score witnessed a decline of 15 points from the preceding year. The rebound in satisfaction is undoubtedly a positive development, bringing an element of optimism to the dental insurance landscape.

J.D. Power’s ranking methodology took into consideration five significant factors that contribute to overall customer satisfaction in dental insurance plan providers. These factors provide a comprehensive look at what truly matters to consumers when they select dental coverage.

The factors, listed in order of their importance, include Cost, Plan Coverage, Communication, Customer Service, and Claims and Reimbursement. These elements represent the cornerstone of a reliable and trustworthy dental insurance provider, each contributing uniquely to a customer’s overall satisfaction and experience.

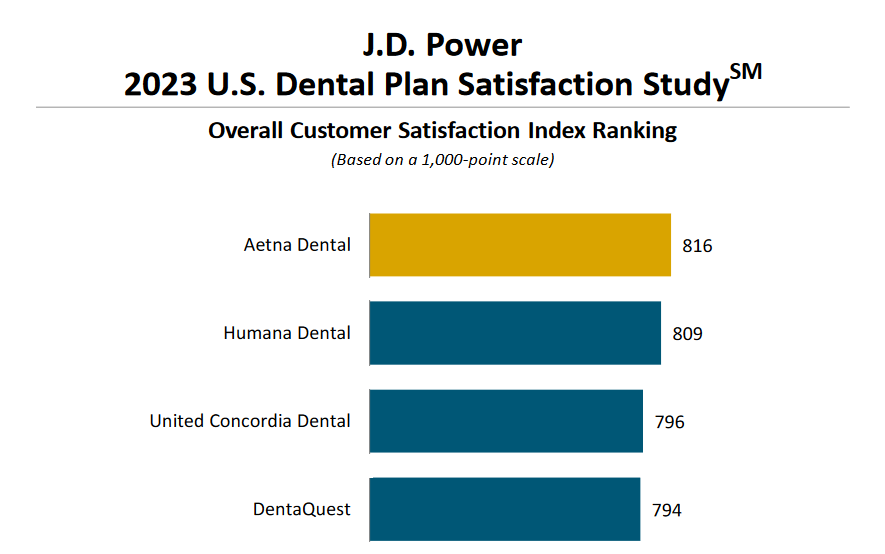

Of the many providers evaluated in the study, four dental plan providers earned above-average overall customer satisfaction scores. These scores represent the cumulative rating of the five crucial factors, giving us a comprehensive look at the top performers in the industry.

The top plans in the report, and their scores, are:

- Aetna Dental: 816 out of 1,000 points

- Humana Dental: 809

- United Concordia Dental: 796

- DentaQuest: 794

Sitting comfortably at the top is Aetna Dental, scoring an impressive 816 out of 1,000 points. Aetna’s high score reflects the company’s commitment to providing comprehensive coverage, excellent customer service, and overall value to its customers.

Closely following Aetna is Humana Dental, with a score of 809. Humana’s robust dental plan offerings and commitment to customer service have made it a favorite among customers, as reflected in its high score.

United Concordia Dental takes the third spot, earning a commendable 796 points. Known for its robust plan coverage and efficient claim and reimbursement process, United Concordia Dental has rightfully earned its spot in the top four.

Rounding out the top four is DentaQuest, with a score of 794. DentaQuest is recognized for its affordable plans and effective communication strategies, bolstering its customer satisfaction score.

In conclusion, the landscape of dental insurers is as diverse as it is vast. However, Aetna Dental, Humana Dental, United Concordia Dental, and DentaQuest have proven to stand out from the crowd in 2023. These top performers have not only exceeded average customer satisfaction scores but also established themselves as leaders in the industry. As the world of dental insurance continues to evolve, these providers exemplify the standards and values that customers find most important.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/the-top-4-dental-insurers-of-2023-according-to-customer-satisfaction.html