Health insurance is a crucial aspect of financial planning and well-being. It helps protect individuals and families from the high costs of medical treatment and provides peace of mind in the event of an unexpected illness or injury. However, choosing the right health insurance plan can be a daunting task, with many factors to consider. In this article, we will outline 10 key considerations to help you make an informed decision when purchasing health insurance.

Before making a decision, it is important to understand your medical needs and the types of services you are likely to need in the future. Consider the doctors you see regularly and the medications you take, as well as any pre-existing conditions that require ongoing treatment. This information will help you determine the coverage you need and the types of insurance plans that will best suit your needs.

Before purchasing health insurance, it is important to consider the following factors:

- Coverage: Determine what medical expenses you want to be covered, including hospital stays, doctor visits, and prescription drugs.

- Network: Consider the healthcare providers in the insurance company’s network and whether your preferred doctors and hospitals are included.

- Deductibles and copays: Understand the costs you will be responsible for, such as deductibles and copays, and how they will impact your overall expenses.

- Premiums: Compare the monthly premium costs of different insurance plans to find one that fits your budget.

- Out-of-pocket maximum: Consider the maximum amount you may be required to pay out-of-pocket for covered expenses in a given year.

- Pre-existing conditions: Make sure the insurance plan covers any pre-existing conditions you have.

- Lifetime maximum: Be aware of the maximum amount of coverage the insurance company will provide over your lifetime.

- Provider restrictions: Check for any restrictions on seeing certain providers or receiving certain treatments.

- Claim process: Research the insurance company’s claim process, including the documentation required and the timeline for processing claims.

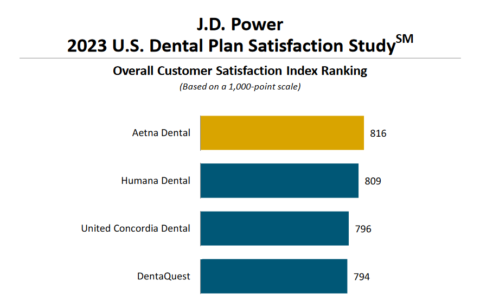

- Customer service: Consider the level of customer service offered by the insurance company, such as availability of customer service representatives and ease of contacting them.

It is also recommended to review your options and compare insurance plans carefully before making a decision. You may also want to consult with a financial advisor or insurance agent to help you choose the best plan for your needs.

It is also important to consider the level of customer service offered by the insurance company, including the availability of customer service representatives and the ease of contacting them. Research the insurance company’s claim process and make sure you understand the documentation required and the timeline for processing claims. Make sure to choose a plan that provides prompt and efficient customer service, as well as a clear and straightforward claims process.

In conclusion, purchasing health insurance is a critical decision that requires careful consideration of multiple factors. By understanding your medical needs and comparing different insurance plans, you can make an informed decision that meets your needs and provides you with the peace of mind you deserve. Remember to review your options carefully, consult with a financial advisor or insurance agent, and choose a plan that fits your budget and provides the coverage you need.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/10-factors-to-consider-before-purchasing-health-insurance.html