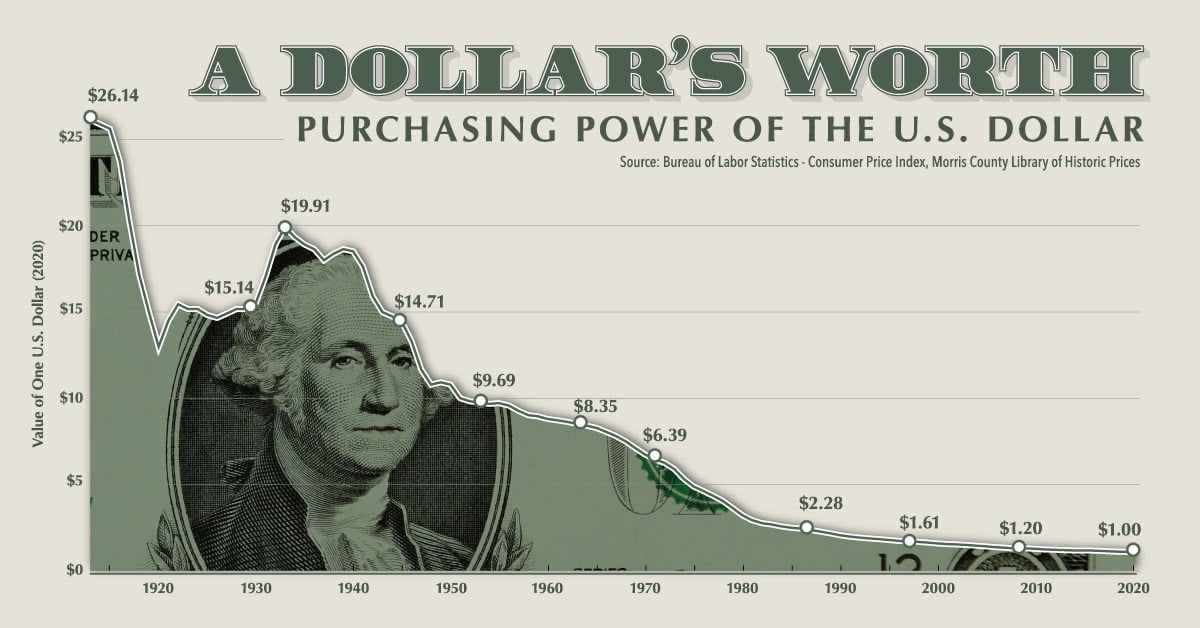

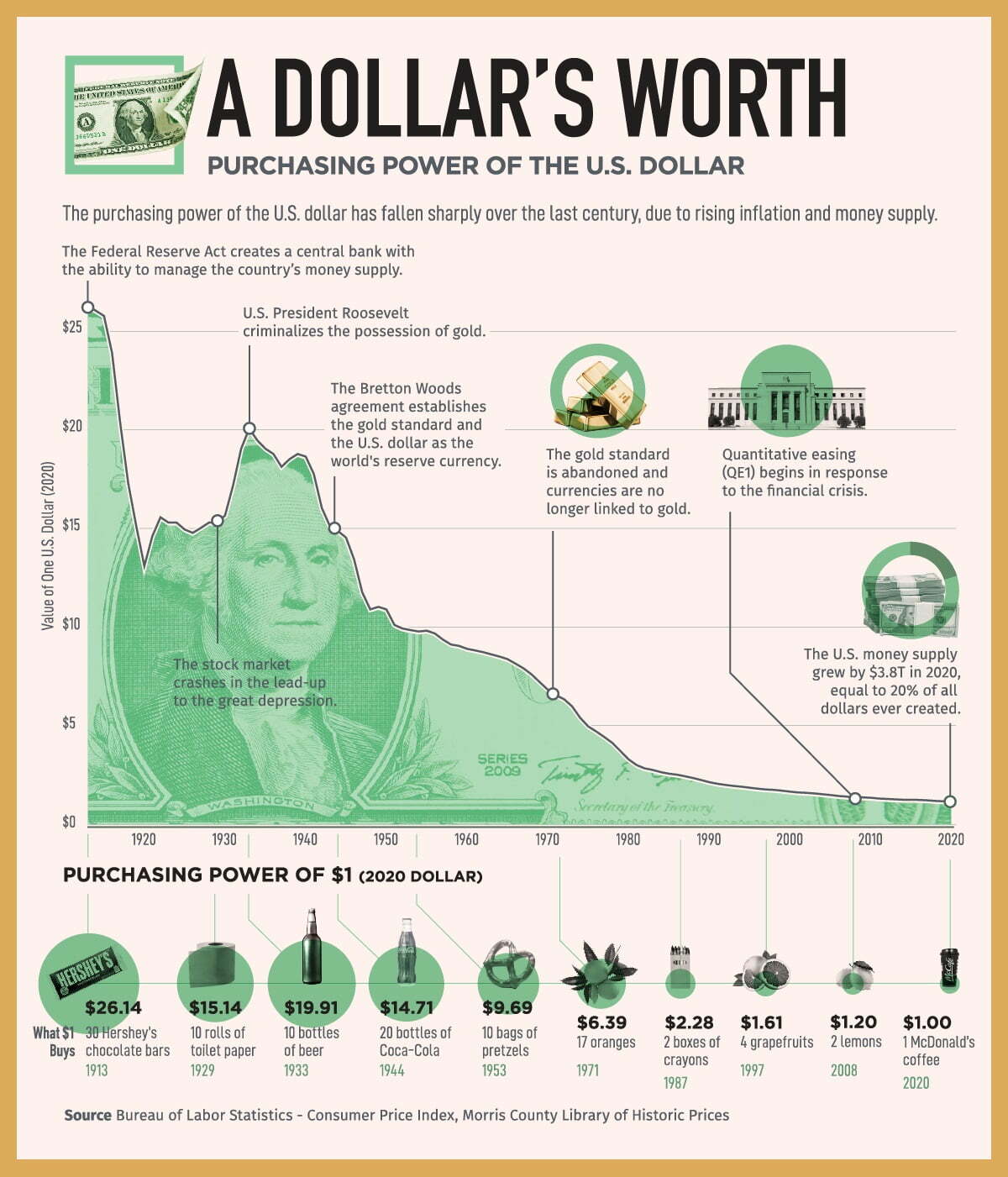

As the world’s reserve currency, the U.S. Dollar has often been taken for granted, but over time it has become increasingly devalued. In the past few decades, the U.S. Dollar has seen a steady decline in its purchasing power. As inflation and other economic factors continue to drive up prices, the real value of our money has been steadily eroded. In this article, we’ll explore how this phenomenon has occurred, and what you can do to protect your own wealth against such losses.

Introduction

It’s no secret that the purchasing power of the U.S. dollar has declined over time. In fact, it’s been on a steady decline for several decades now. And, while there are a number of factors contributing to this decline, the primary culprit is inflation.

Inflation is defined as the gradual increase in the price of goods and services over time. And, while a small amount of inflation is considered normal and even necessary for a healthy economy, too much inflation can be harmful.

When inflation is high, each dollar you have buys less and less. So, if you’re living on a fixed income or your wages aren’t keeping up with the cost of living, your standard of living will decline.

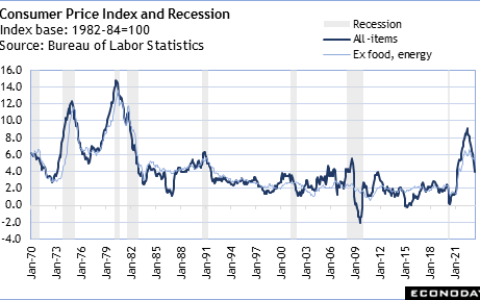

There are a number of ways to measure the purchasing power of the dollar over time, but one of the most common is to look at the Consumer Price Index (CPI). The CPI measures changes in prices paid by consumers for a basket of goods and services. And, according to the Bureau of Labor Statistics, the CPI has more than doubled since 1970.

This means that what would have cost you $100 in 1970 would now cost you over $200 – just to maintain the same standard of living. And, if your income hasn’t kept pace with inflation, your purchasing power has declined even further.

The good news is that there are things you can do to protect yourself from inflation and the declining purchasing power of the dollar. In this article, we’ll take a look at how you can do that, including investing in inflation-protected investments and diversifying your portfolio. We’ll also discuss some strategies for managing your money in order to maximize your financial security in an uncertain economic environment.

The History of U.S. Inflation and Purchasing Power

Inflation is the rate at which prices for goods and services increase over time. The purchasing power of a currency is the amount of goods or services that can be bought with that currency. In the United States, both inflation and the purchasing power of the dollar have declined significantly over time.

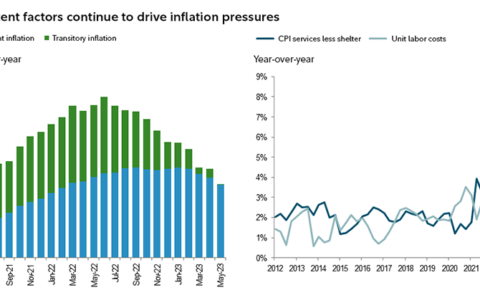

Inflation in the United States began to rise in the early 1970s, after several decades of relatively low prices. By 1980, inflation was averaging more than 10% per year. The high inflation rates of the 1970s and early 1980s were caused by a number of factors, including an increase in oil prices, increases in government spending, and rapid growth in the money supply.

The Federal Reserve responded to high inflation by raising interest rates and adopting other policies to slow the growth of the money supply. These policies were successful in reducing inflation, but they also contributed to a severe recession in 1981-82. After the recession ended, inflation fell sharply and remained low for several years.

However, inflation began to rise again in the late 1980s and early 1990s. This ‘second wave’ of inflation was caused by several factors, including an increase in government spending (which led to higher budget deficits), an expansionary monetary policy (which led to higher levels of money growth), and structural problems in the economy (such as a decline in productivity growth).

The Fed responded to this second wave of inflation by once again raising interest rates and taking other steps to slow economic growth.

The result of these policies was an increase in the purchasing power of the dollar. From 1980 to 2000, the purchasing power of the dollar rose more than 40%. This period is sometimes referred to as the ‘Great Moderation,’ because inflation and economic growth were both relatively low and stable.

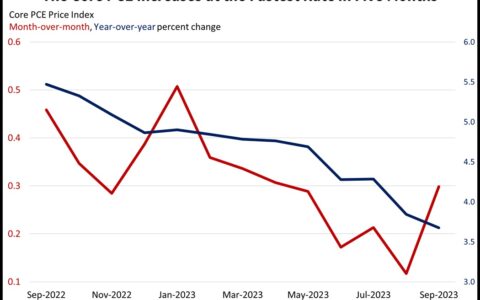

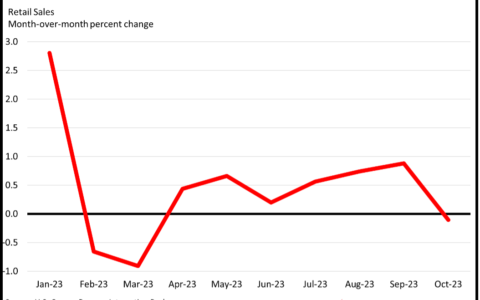

Since then, however, there have been several periods of rising inflation. In 2008-09, for instance, prices rose rapidly as a result of higher oil prices and an expansionary monetary policy. Since then, inflation has remained relatively low due to weak economic growth and deflationary pressures in some sectors (such as housing).

Overall, inflation in the United States has been volatile over the past four decades. Although prices have risen significantly since 1980, they have also fallen sharply at times. As a result, the purchasing power of the dollar has fluctuated considerably since then.

What Causes the Decline in Purchasing Power?

When it comes to the purchasing power of the US dollar, there are a number of factors that contribute to its decline. Inflation is one of the most significant drivers of this decline, as prices for goods and services increase over time while the value of the dollar remains static. This means that each dollar you have today will buy less than it would have in the past, as inflation erodes its purchasing power.

Other factors that can contribute to the decline in purchasing power include economic recession and high levels of government debt. When these things occur, confidence in the US economy declines and investors seek out other currencies that they perceive as being more stable. This can cause the value of the dollar to fall relative to other currencies, further reducing its purchasing power.

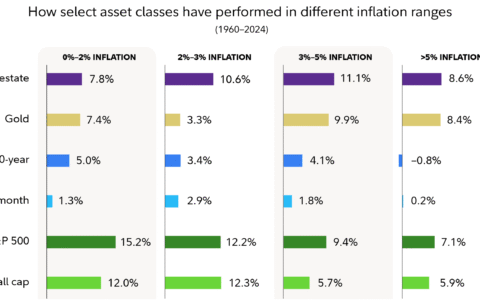

There are a few things that you can do to protect yourself from the declining purchasing power of the US dollar. One is to diversify your portfolio by investing in assets denominated in other currencies. Another is to invest in commodities like gold or silver, which tend to hold their value relatively well even when fiat currencies are struggling. Finally, you can simply make sure to stay informed about what’s happening with the economy and adjust your investment strategy accordingly.

How to Protect Yourself from Inflation

Inflation is often thought of as an increase in the prices of goods and services. While this is true, inflation is actually a decrease in the purchasing power of money. When inflation goes up, each dollar you have buys less than it did before. Over time, this can have a significant impact on your purchasing power and standard of living.

There are a number of things you can do to protect yourself from inflation:

1. Invest in assets that tend to hold their value over time. This includes things like precious metals, real estate, and collectibles.

2. Diversify your investments. Don’t put all your eggs in one basket. This will help reduce the overall risk to your portfolio.

3. Stay informed about changes in the economy and Monetary Policy. The Federal Reserve sets interest rates and prints money, both of which can impact inflation. By staying up-to-date on these changes, you can adjust your investment strategy accordingly.

4. Have an emergency fund to cover unexpected expenses. This will help ensure that you don’t have to sell investments at a loss if inflation unexpectedly spikes higher.

5. Live below your means. This may seem like an obvious one, but it’s worth repeating nonetheless. If you spend less than you earn, you’ll be in a better position to weather any storm – including periods of high inflation.

Tips for Investing Wisely During Times of Inflation

When it comes to investing during periods of inflation, there are a few things that you can do in order to make sure that your money grows along with the cost of living. Here are a few tips to keep in mind:

-Invest in assets that will maintain or increase in value as the cost of living goes up. This includes things like precious metals, real estate, and collectibles.

-Avoid putting all of your eggs in one basket. Diversify your portfolio so that you have investments in different asset classes. This will help to protect you from losses if one particular asset class takes a hit.

-Keep an eye on interest rates. As inflation rises, so do interest rates. This means that you can earn more on your investments by investing in products like bonds and CD’s.

-Think long-term. When it comes to investing during periods of inflation, it’s important to take a long-term view. Don’t be tempted to cash out of your investments at the first sign of trouble – chances are good that they will rebound over time if you give them a chance.

Conclusion

The U.S. dollar has seen a steady decline in purchasing power over the years, and it is important to be aware of this so that you can make informed decisions about your own finances. Despite this issue, there are still ways for you to preserve the value of your hard-earned money; by diversifying your investments, taking advantage of inflation-proofing methods such as investing in gold or silver coins and keeping your expenses low, you can ensure that your money will remain valuable even if the U.S. dollar continues to lose purchasing power over time.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/us-dollar-purchasing-power.html