Investing can be a great way to grow your wealth over time, but it can also be overwhelming for beginners. With so many options to choose from, it can be difficult to know where to start. In this article, we will focus on investing in the stock market, which can be a great starting point for those new to investing. We will also discuss other types of investments such as real estate, bonds, precious metals, and cryptocurrencies.

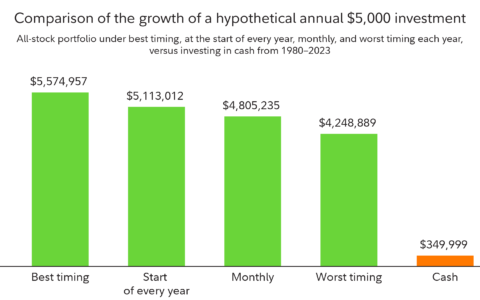

The first step in investing is to establish your investment goals. Do you want to save for retirement, or are you looking to make a quick profit? Your goals will help determine the types of investments that are right for you. For example, if you are saving for retirement, you may want to invest in stocks that offer long-term growth potential. If you are looking to make a quick profit, you may want to invest in more speculative stocks.

Once you have established your investment goals, you need to decide how much money you want to invest. It’s important to remember that investing always involves some level of risk, so you should never invest more than you can afford to lose. A good rule of thumb is to invest only what you can afford to lose without affecting your standard of living.

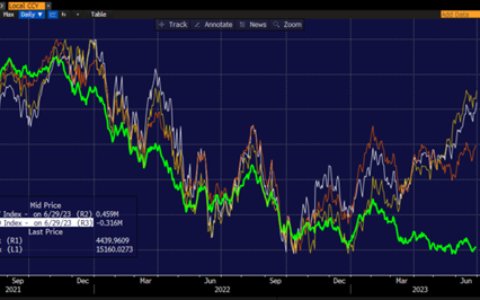

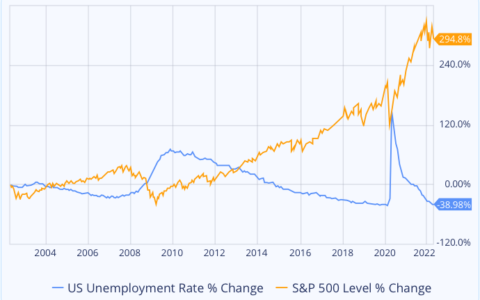

Once you have established your investment goals and determined how much money you want to invest, it’s time to start researching different types of investments. The stock market is a great place to start, as it offers a wide variety of companies to invest in and is relatively easy to understand. There are many online resources and tools that can help you research different stocks and mutual funds, such as Morningstar and Yahoo Finance.

Real estate is another popular investment option, particularly for those looking for a long-term investment. Real estate can be a great way to generate passive income, but it also requires a significant amount of research and due diligence. It’s important to understand the local real estate market and to have a good understanding of the property you are considering investing in.

Bonds are another type of investment that can be suitable for beginners. Bonds are essentially loans that are made to a company or government. They offer a relatively low level of risk and can be a great way to diversify your portfolio.

Precious metals such as gold and silver can be a good investment for those who are looking for a hedge against inflation. These types of investments can be less volatile than stocks, but they can also be more difficult to value.

Finally, cryptocurrencies such as Bitcoin and Ethereum have become increasingly popular in recent years. These types of investments are highly speculative and can be very volatile, so they may not be suitable for beginners.

In conclusion, investing can be a great way to grow your wealth over time, but it can also be overwhelming for beginners. It’s important to establish your investment goals, determine how much money you want to invest, and research different types of investments. The stock market is a great place to start, but other options such as real estate, bonds, precious metals, and cryptocurrencies can also be considered. As always, it is important to consult with a financial advisor before making any investment decisions.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/a-beginners-guide-to-investing-understanding-the-stock-market-and-other-investment-options.html