Building an investment portfolio from scratch can be a daunting task for beginners, but with the right approach and knowledge, it can be a rewarding process. A well-diversified investment portfolio should include a mix of different asset classes, such as stocks, bonds, real estate, precious metals, and even cryptocurrencies. In this article, we will explore the different types of investments and strategies that beginners can use to build a solid investment portfolio.

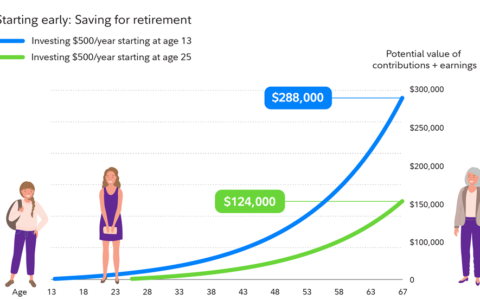

The first step in building an investment portfolio is to establish your investment goals. Are you saving for retirement, or are you looking to make a quick profit? Your goals will determine the types of investments that are right for you. For example, if you are saving for retirement, you may want to invest in stocks that offer long-term growth potential, or in bonds that provide a steady stream of income. If you are looking to make a quick profit, you may want to invest in more speculative stocks or real estate.

The next step is to determine your risk tolerance. Risk tolerance is the amount of risk that you are willing to take on in pursuit of potential returns. It is important to understand your risk tolerance as it will help you to determine the types of investments that are right for you. For example, if you have a low risk tolerance, you may want to invest in bonds or precious metals, while if you have a high risk tolerance, you may want to invest in stocks or real estate.

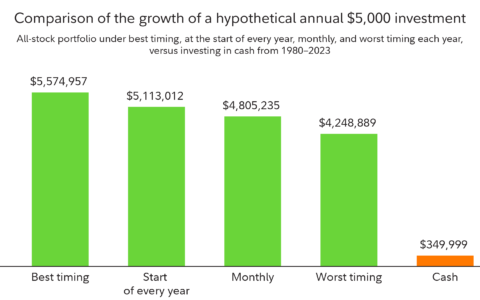

Once you have established your investment goals and determined your risk tolerance, it’s time to start researching different types of investments. According to a report by the investment company, Vanguard, a well-diversified portfolio should typically include a mix of stocks, bonds, and cash. Stocks represent ownership in a company and can provide long-term growth potential. Bonds, on the other hand, represent debt and can provide a steady stream of income. Cash, also known as cash equivalents, can provide a safety net in case of market downturns.

Real estate is another popular investment option, particularly for those looking for a long-term investment. According to the National Association of Realtors, the average annual return on real estate investment properties was 8.9% from 2000 to 2019. Real estate can be a great way to generate passive income, but it also requires a significant amount of research and due diligence. It’s important to understand the local real estate market and to have a good understanding of the property you are considering investing in.

Precious metals such as gold and silver can be a good investment for those who are looking for a hedge against inflation. According to the World Gold Council, the average annual return on gold investment was 11.6% from 2000 to 2019. These types of investments can be less volatile than stocks, but they can also be more difficult to value.

Finally, cryptocurrencies such as Bitcoin and Ethereum have become increasingly popular in recent years. According to Coinmarketcap, the average annual return on Bitcoin was 365% in 2017. These types of investments are highly speculative and can be very volatile, so they may not be suitable for beginners.

In conclusion, building an investment portfolio from scratch can be a daunting task for beginners, but with the right approach and knowledge, it can be a rewarding process. It’s important to establish your investment goals, determine your risk tolerance and research different types of investments. A well-diversified portfolio should typically include a mix of stocks, bonds, cash, real estate, precious metals and even cryptocurrencies. As always, it is important to consult with a financial advisor before making any investment decisions.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/building-a-strong-investment-portfolio-from-scratch-a-beginners-guide-to-diversifying-your-investments.html