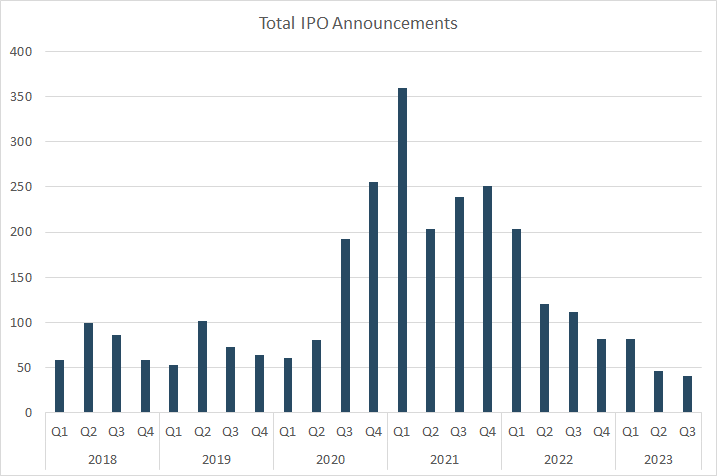

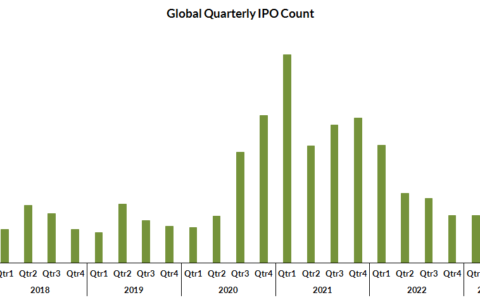

The recent years have witnessed a waning interest in Initial Public Offerings (IPOs). As the second quarter of 2023 drew to a close, it marked the sixth consecutive quarter of declining YoY IPO activity. This lackluster performance harks back to the same scenario we saw in early 2016. But as we approach the close of the third quarter, there’s a ray of hope emerging on the horizon.

The third quarter has unveiled 41 deals up till September 11, just five deals shy of the total count for the whole of Q2. Given that there are still three weeks left, this could very well turn out to be the first quarter in 18 months to record a YoY increase in IPO activity. So, what’s behind this potential turnaround?

The Forthcoming Heavyweights: Arm Holdings & Instacart

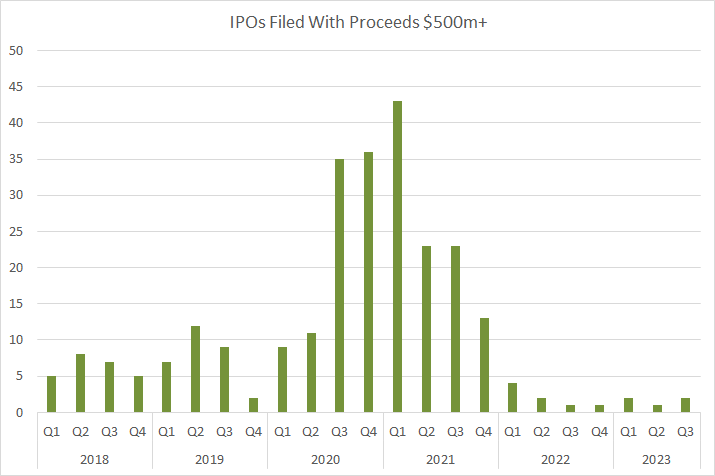

One of the most eagerly awaited events in the investment world is the IPO of Arm Holdings, set to begin trading on September 14. The British semiconductor and software design company has priced its shares between $47 and $51. With 95.5M shares being offered, this could rake in almost $4.9B, evaluating the company at a whopping $54.5B.

Following closely on its heels is Instacart. The American grocery pickup and delivery service made headlines by filing for its IPO, with an offer price set between $26-$28/share. If all goes according to plan, the company could accumulate more than $600M, leading to a valuation of around $9.3B.

We also have Klaviyo, Inc. joining the bandwagon. The tech firm from Boston, known for its marketing automation platform, is slated to go live on September 19, aiming for proceeds close to $500M.

The Evolution of the IPO Landscape

The enthusiasm for IPOs, particularly in 2020 and 2021, seems like a distant memory now. Back then, massive listings were the norm. However, things seem to be taking a slow and steady turn. The upcoming IPOs of Arm and Instacart, followed by potential listings from giants like Databricks, Stripe, and Chime, may change the game in 2023 or 2024.

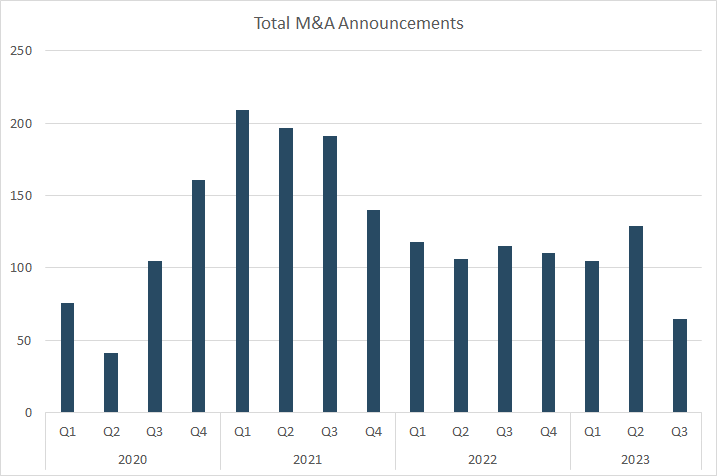

Mergers & Acquisitions – A Mixed Bag

M&A activities had their moment under the sun in Q2 after a slump in the two previous quarters. Unfortunately, Q3 is not reflecting the same momentum. That said, the quarter has seen its share of significant deals, particularly in the consumer staples sector. The announcement of Campbell Soup Company’s acquisition of Sovos Brands and J.M. Smucker’s acquisition of Hostess Brands are cases in point.

In Conclusion

The world of IPOs is a complex interplay of various factors. Emerging enterprises, and even some of the more established players, tread cautiously to ensure substantial demand for their stocks before they dive into the secondary market. Simultaneously, private equity stalwarts and investment bankers are perpetually on the lookout for promising ventures.

As the IPO climate seems to be veering towards a more optimistic direction after a period of stagnation, it becomes imperative for investors to stay updated on the unfolding events in the domain of newly listed companies. This transitional phase in the market, highlighted by significant players like Arm and Instacart, could very well define the trajectory of IPOs in the coming years.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/arm-and-instacart-the-potential-catalysts-for-the-ipo-revival.html

Comments(1)

The IPO market has been ice cold in 2022. Q2 2023 marked the sixth straight quarter of declining year-over-year IPO activity, the longest such streak since the 2008-2009 financial crisis. But some high profile upcoming deals have given investors hope for a thaw.

The most anticipated IPO of the second half of 2023 is Arm Holdings, the semiconductor technology company that designs processor architectures used in most smartphones. Arm is set to begin trading this Thursday, September 14th, at an expected valuation of $54.5 billion.

Another major offering investors are keenly watching is grocery delivery app Instacart, which just filed its IPO paperwork earlier this week. Instacart plans to raise over $600 million at a $9.3 billion valuation when it goes public next Wednesday, September 20th.

These prominent deals have sparked optimism that the IPO pipeline may be reopening after an extremely slow first half of 2023. Only 46 companies went public globally in Q2, the lowest tally since early 2016. But Q3 is currently on pace for at least 41, and momentum seems to be building.

Other tech IPOs to watch include marketing automation platform Klaviyo, expected to raise nearly $500 million starting September 19th.

However, massive, billion-dollar-plus IPOs have become a rarity in the current market environment. While Arm and Instacart will be substantial offerings, they pale in size compared to the blockbuster deals of 2020-2021.

Some private tech giants still waiting in the wings for the right time to go public include data analytics firm Databricks, payments processor Stripe, and digital bank Chime. But their IPOs likely won’t materialize until market conditions improve.

The revival of M&A activity is another positive sign for markets after a slow start to 2023. Global M&A deal value jumped in Q2 but has since stagnated in Q3 so far. Notable recent deals include Campbell Soup’s $2.33 billion purchase of pasta sauce maker Sovos Brands and J.M. Smucker’s $5.6 billion acquisition of Hostess Brands.

In summary, while the IPO market remains challenging, there are finally some concrete reasons for optimism. If high-profile listings from Arm, Instacart and others go smoothly over the next few weeks, it could entice more private companies to test the public waters. But economic uncertainty still abounds, so a broader IPO rebound is far from guaranteed. Investors should closely monitor upcoming new issues for signs of spring in the markets.