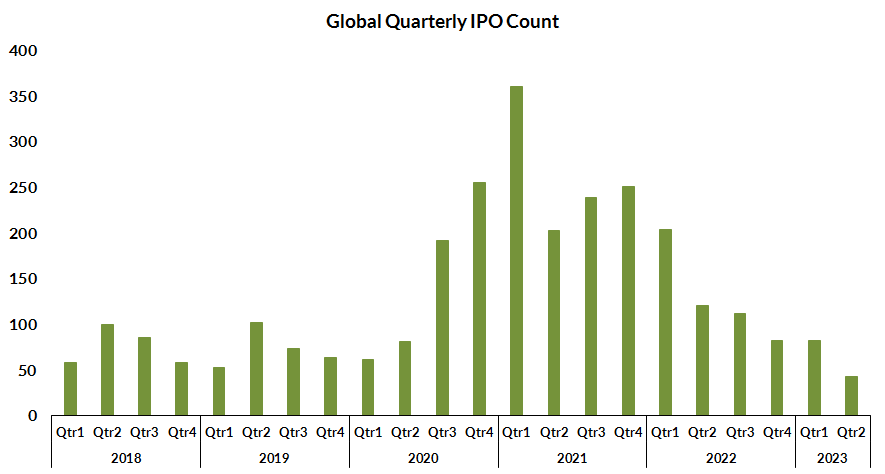

The IPO market has witnessed a significant slowdown over the past year and a half. Q2 2023 marked the seventh consecutive quarter of year-on-year decline in IPO activity, and the April-June stretch stands as the weakest since early 2016. With higher borrowing rates and the regional banking turmoil of last March, investment bankers and young private firms have had their share of difficulties. However, the ever-optimistic Wall Street bulls are starting to see a silver lining.

An intriguing dynamic in the second half of 2023 is the anticipated surge in IPOs propelled by the AI boom and a dose of social proof. Despite the looming threat of a global growth slowdown through early 2024, the potential resurgence of IPOs and the excitement in the M&A world serve as hopeful indicators.

The capital market landscape has evolved drastically since the peak of Wall Street “bubbliciousness” in early 2021. Startups and speculative SPACs enjoyed substantial investor capital inflow and solid initial equity returns. However, a successful NYSE trading opening for a fresh IPO company has become a rare sight over the past 18 months. Signs of change are in the air, and Wall Street is buzzing with the prospect of more IPO activity later this year.

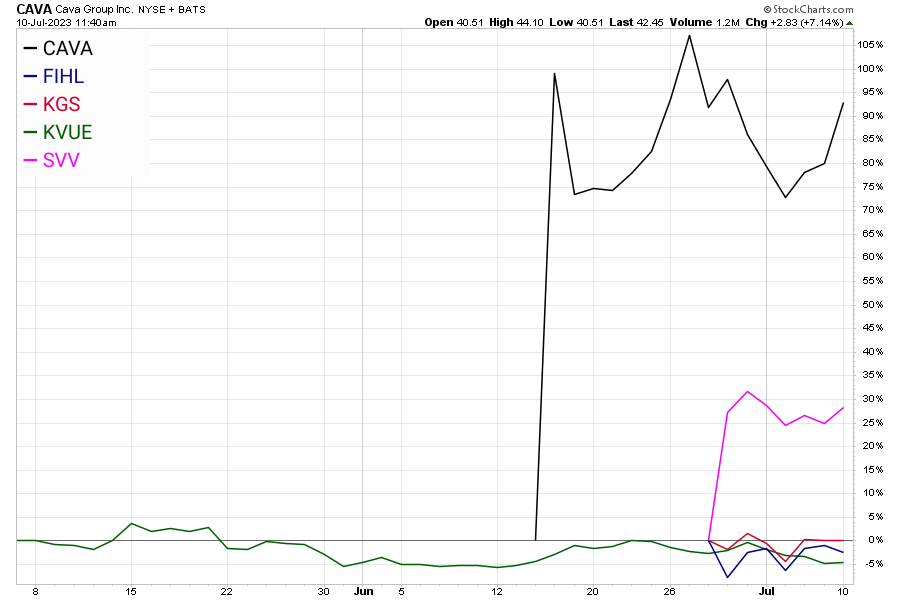

A diverse set of companies, including Kenvue (KVUE), CAVA Group (CAVA), Savers Value Village (SVV), Kodiak Gas Services (KGS), and Fidelis Insurance (FIHL), have already initiated a positive tone on Wall Street with their new public listings.

Kenvue was the first significant company to IPO this year, experiencing a 20% stock market launch surge, followed by a 15% increase through early July. CAVA, a Mediterranean restaurant chain, nearly doubled its debut, despite the initial volatility. Savers Value Village, backed by Ares Management, showed a solid exit, with shares priced at $18 that swiftly ascended to above $23. The public launch of Kodiak Gas Services and Fidelis Insurance, despite their minor setbacks, also points to an invigorating IPO market.

Looking forward, although July and August are traditionally weak for IPOs, optimism abounds for a pickup in equity offerings in the final four months of 2023. High-profile potential IPOs include international semiconductor company Arm, global payments processor Stripe, as well as promising firms like Reddit, Instacart, Chime, Discord, and Panera. Additionally, signs of regulatory relaxation in China might prompt prominent Chinese companies to explore the IPO path.

The IPO market involves a delicate interplay between art and science. Companies eyeing public markets require confidence in the demand for their shares. Private equity firms and investment bankers also search for auspicious signs to ensure their investments pay off and underwrite quality deals. Amid this complex scenario, investors should keep abreast of the latest events in the newly listed companies’ sphere.

In conclusion, despite the lull, the IPO market is showing signs of life, attracting optimism for the latter half of 2023. While the road ahead is fraught with uncertainties, investors, companies, and bankers alike can anticipate the rejuvenation of the IPO market. While this isn’t a floodgates scenario, the increased testing of secondary market waters points to a cautiously hopeful climate. It’s a cautious watch-and-wait game in the IPO world, but it’s one that Wall Street observers are keen to play.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/the-rebirth-of-the-ipo-market-anticipating-a-revival-amid-wall-street-optimism.html