In the world of finance, veterans often rely on the Cboe Volatility Index (VIX) to gauge the market’s anticipation of volatility over the next 30 days. However, a curious scenario has emerged as VIX languishes in the 12-13 range despite historical precedents of higher levels during periods of investor optimism. This prompts us to explore the question: Has volatility been permanently subdued, or are there underlying factors at play that might suggest a different narrative?

The Nature of VIX: More Than Just a Fear Gauge

It’s crucial to dispel the notion that VIX is a direct measure of fear. While there is a correlation between fear and VIX, the index primarily reflects the market’s best estimate of volatility. Traders, influenced by recency bias, often anticipate ongoing market conditions. However, recent developments introduce other dynamics into the equation.

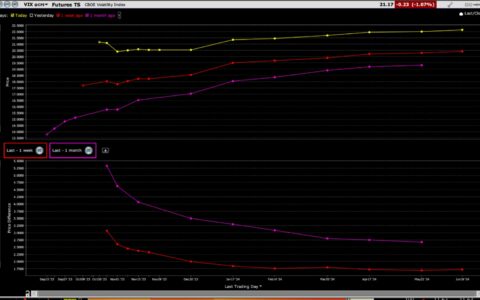

One noteworthy aspect is the composition of VIX, which considers all S&P 500 options, both puts and calls, with 23-37 days to expiration and bids of a penny or more. If implied volatilities of calls are low, this affects VIX. Recent trends reveal a surge in ETFs employing strategies involving the selling of volatility, such as JEPI, XYLD, QYLD, PBP, and others. Though these ETFs commonly use the relatively benign strategy of writing covered calls, the sheer volume of these calls entering the market impacts prices, contributing to the dampening of implied volatilities.

Correlation of Components within Indices

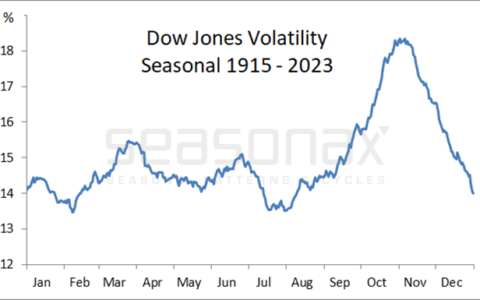

Another influential factor is the correlation among stocks within the S&P 500. High correlations result in increased index volatilities, while low correlations have a dampening effect. To illustrate, imagine a two-stock index where one stock rises while the other falls by a similar amount—the overall index remains relatively stable. However, if the stocks move in sync, the index will reflect substantial volatility. This correlation, or lack thereof, significantly influences the movement of the index.

“Socially Acceptable Volatility” and Asymmetry in VIX Response

While volatility calculations don’t account for the direction of stock or index movement, investors certainly do. The concept of “socially acceptable volatility” underscores the preference for upward market trends. Investors are generally uneasy when markets decline, prompting them to seek volatility protection, subsequently boosting VIX. This asymmetry in response to up and down moves is a fundamental characteristic of VIX.

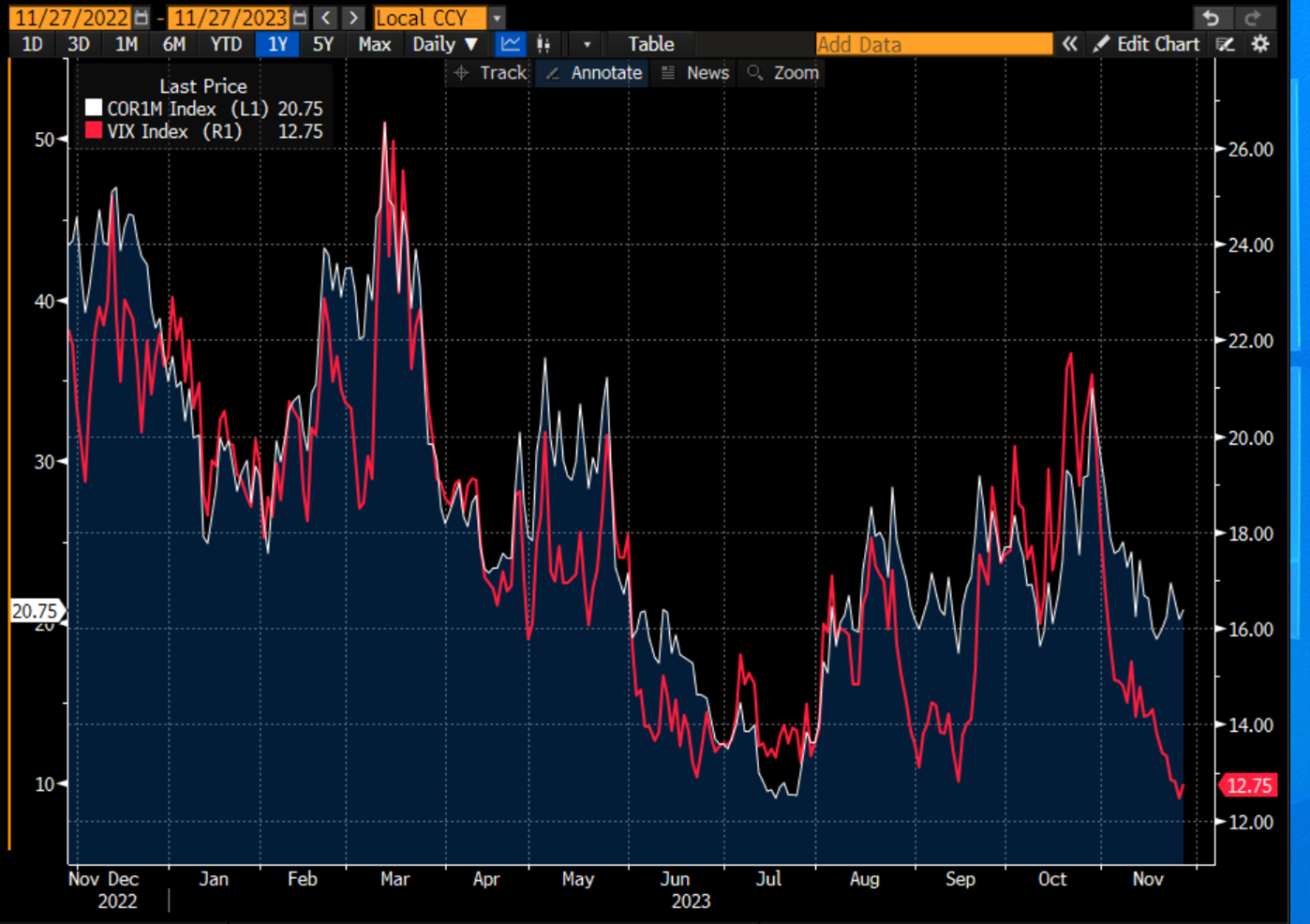

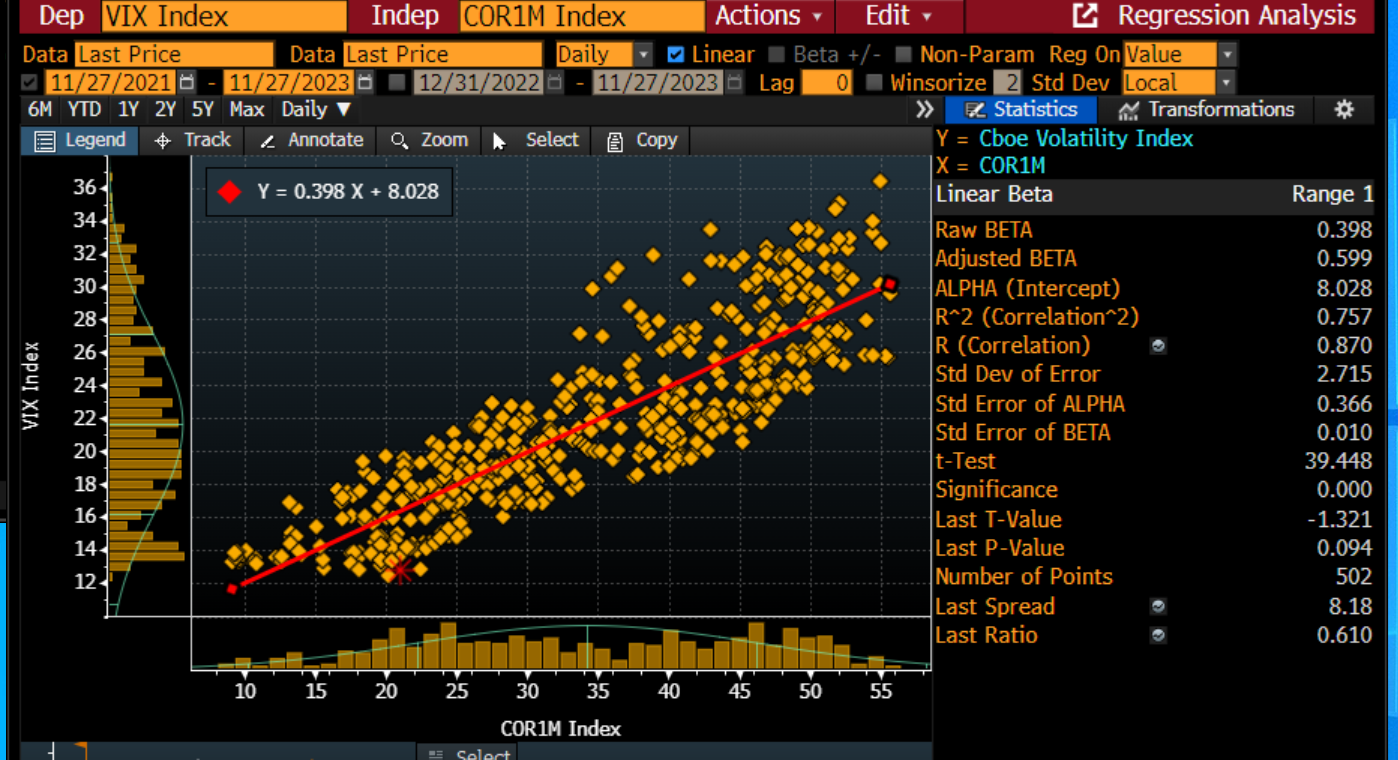

Analyzing the Data: VIX vs. COR1M

Turning our attention to the Cboe’s 1-Month Implied Correlation Index (COR1M), a crucial consideration arises. The correlation between VIX and COR1M is traditionally solid, yet recent data reveals an anomaly. Despite historical correlation patterns, the current data point stands near the lowest levels observed in the past two years. This raises a critical question: Are traders too complacent at present, or is the depressed VIX level justified given the correlation of its components?

Conclusion: Unraveling the Puzzle

In conclusion, the prevailing low levels of VIX may be indicative of a market that is seemingly complacent. However, it is crucial to consider the complex interplay of factors such as ETF strategies, stock correlations, and the human tendency to favor upward market movements. The current disparity between VIX and COR1M suggests that mechanical selling by ETFs could be a contributing factor to the subdued volatility levels.

As financial professionals, it’s essential to approach the market with a nuanced understanding, recognizing that volatility is influenced by a myriad of factors. While the current environment may appear calm, the intricate dance of market forces may hold surprises, reminding us that in the ever-evolving world of finance, permanence is a rare commodity. As we navigate these uncertain waters, a watchful eye on VIX and its correlations will undoubtedly provide valuable insights into the market’s future trajectory.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/has-volatility-been-permanently-subdued-unraveling-the-mysteries-behind-vixs-low-levels.html