Introduction

In the world of finance and economics, few indicators have been as closely scrutinized and widely discussed as the yield curve. The inversion of the yield curve, specifically the U.S. Treasury yield curve, has often been heralded as a harbinger of impending recession. However, in recent times, the yield curve’s predictive power has come under question as it defies conventional wisdom. So, have inverted yield curves lost their way? Let’s delve into the intricacies of this intriguing phenomenon and see if it’s time to rewrite the rulebook.

The Inversion Saga

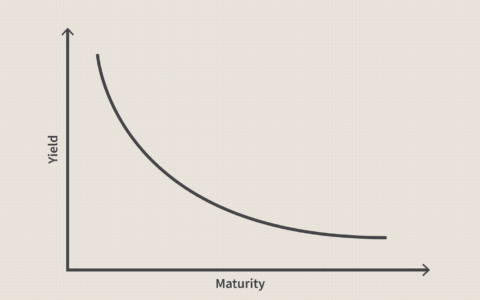

It wasn’t too long ago that inverted yield curves were all the rage. The term “inverted yield curve” refers to a situation where short-term interest rates are higher than long-term rates, resulting in a downward-sloping curve. Historically, this inversion was viewed as a near-certain sign of an impending recession. But things have taken an interesting turn in recent times.

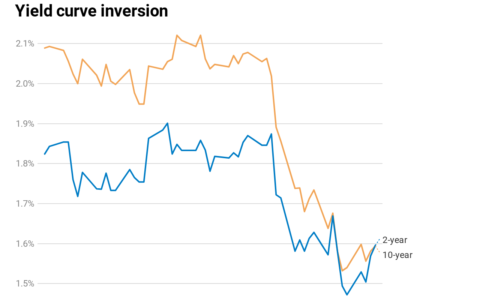

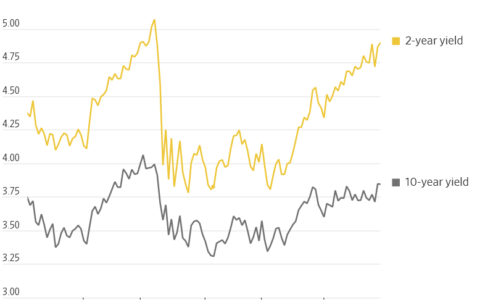

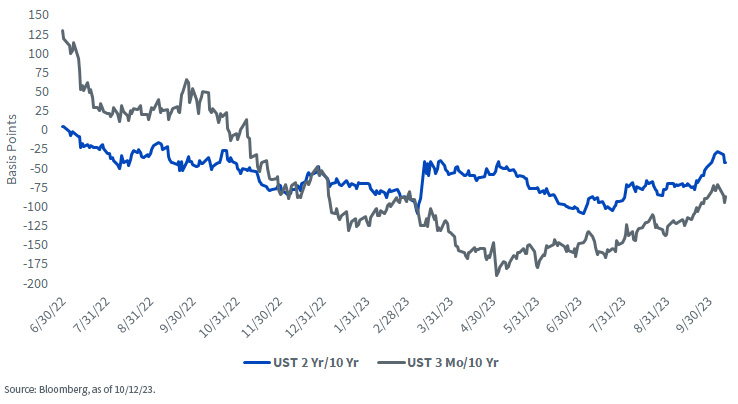

Two of the most closely watched yield curve constructs, the U.S. Treasury 3-month/10-year and 2-year/10-year, both dipped into negative territory at different points in the past year. The 2-year/10-year spread inverted at the end of June, while the 3-month/10-year differential went negative in the fall of 2022. The inversion deepened over time, with the 2-year/10-year hitting -109 basis points in March, and the 3-month/10-year plummeting to -191 basis points in May. These deep inversions were primarily the result of the Federal Reserve’s aggressive rate hikes, pushing short-term rates up, while the 10-year yield lagged behind.

The Resurgence of Steeper Curves

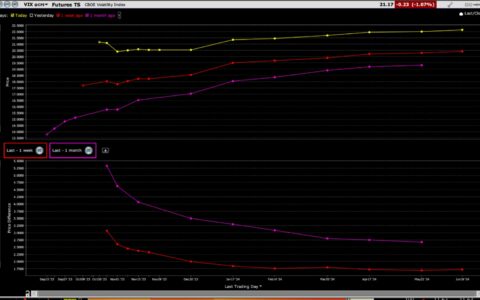

Fast forward to the present, and the story has taken a twist. The Federal Reserve has maintained its Fed Funds target range at 5.25%–5.50%, but the 10-year yield has surged. In just a few months, the U.S. Treasury 10-year yield has risen by about 100 basis points since mid-July, with a substantial 60–70 basis points of that increase occurring in the last six weeks. As a result, the previously inverted yield curves have undergone a remarkable steepening.

For instance, the 2-year/10-year inversion has shrunk by 80 basis points to only -28 basis points following a jobs report, while the 3-month/10-year negative spread has re-steepened by an astonishing 120 basis points to -71 basis points. The yield curve, which was once a stark warning sign, has now undergone a significant transformation.

Historical Context

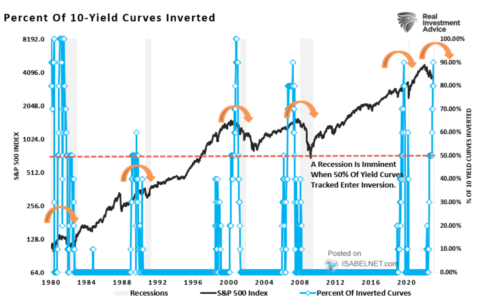

The historical context of inverted yield curves is essential to understanding their current relevance. The U.S. economy did indeed post negative real GDP readings during Q1 and Q2 of the previous year. However, this occurred before the yield curves discussed here went negative. This raises an intriguing question: does a recession necessarily follow the inversion of yield curves, or are we dealing with a more nuanced economic landscape?

Conclusion

As we look ahead, it’s clear that the U.S. economy has thus far avoided a downturn, and the available data suggests that a recession is not imminent. Just like many other economic indicators in these times of change, the timing of events keeps getting pushed back. Could a negative quarter or two of real GDP become a development in 2024? It’s a possibility.

Even with the dramatic steepening of Treasury yield curves, the two constructs highlighted in this blog post still remain inverted. However, it’s important to remember that past Federal Reserve tightening policies rarely achieved a soft landing. As Yogi Berra once said, “it ain’t over till it’s over.” The inverted yield curves may not have lost their way entirely, but they might just be trying to tell us that the path to understanding the economy is more complex than we once thought.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/the-unpredictable-path-of-inverted-yield-curves-are-they-still-the-harbingers-of-recession.html