When it comes to taxes, most investors worry about the “big” mistakes—the kind that might trigger an audit or land them in trouble with the IRS. In reality, the most common tax pitfalls fall into two far more ordinary categories: simple human errors and missed opportunities to legally reduce what you owe.

Both can be costly—not necessarily in penalties, but in stress, lost time, and unnecessary tax bills. And in today’s environment, where tax laws have introduced expanded or newly structured credits and deductions, the stakes are even higher. A little extra diligence—and in many cases, guidance from a tax professional—can significantly improve your financial outcome.

Below are eight tax pitfalls I regularly see as a financial advisor, along with practical steps to avoid them.

1. Simple Math Errors and Miscalculations

It may surprise you, but the IRS consistently reports that the most common problems on tax returns are basic math mistakes. These range from incorrect addition to misapplied tax tables and overlooked decimal errors.

For the 2023 tax year alone, the IRS issued approximately 1 million “math-error” notices. These letters typically correct a return and adjust the taxpayer’s refund or balance due. While not catastrophic, they can delay refunds and create unnecessary anxiety.

How to avoid it:

- Use reputable tax software or work with a professional.

- Double-check manually entered figures.

- Reconcile totals with supporting documents (W-2s, 1099s, brokerage statements).

- Slow down—most math errors happen when rushing to file.

2. Claiming Complex Credits Incorrectly

Tax credits such as the Child Tax Credit and the Earned Income Tax Credit can significantly reduce your tax liability—but they’re also among the most complicated parts of the tax code.

Eligibility thresholds, income phaseouts, dependent qualifications, and filing status requirements can all affect qualification. Miscalculating or misunderstanding eligibility can result in delayed refunds or amended returns.

How to avoid it:

- Carefully review income limits and qualification rules.

- Ensure dependent information is accurate and consistent.

- If your income fluctuates (common for self-employed individuals), double-check how that affects eligibility.

- Seek professional advice if your situation is complex.

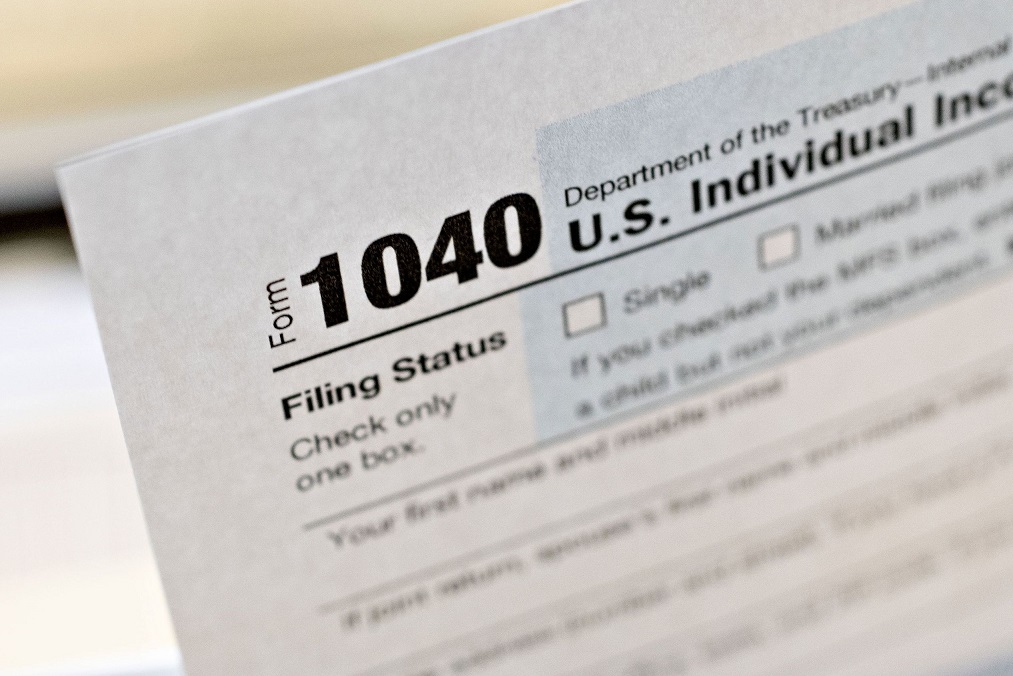

3. Choosing the Wrong Filing Status

Filing status affects your tax bracket, standard deduction, and eligibility for certain credits. Yet many taxpayers mark the wrong box—especially in years when marital status changes due to marriage, divorce, or separation.

Head of Household status, in particular, is frequently misunderstood and misapplied.

How to avoid it:

- Confirm your marital status as of December 31 of the tax year.

- Review IRS definitions of “qualifying person” for Head of Household.

- If separated but not divorced, verify whether you qualify as “considered unmarried.”

Choosing the correct filing status can meaningfully impact your total tax bill.

4. Entering Incorrect Social Security or Bank Account Numbers

Data entry errors are simple—but potentially disruptive. A single incorrect digit in a Social Security number can delay processing. An incorrect bank routing or account number can misdirect your refund.

These aren’t strategic errors—they’re mechanical ones. Yet they are surprisingly common.

How to avoid it:

- Compare entries directly against official documents.

- Have another person review your return before filing.

- Use direct import tools when available to reduce manual entry.

Small administrative diligence saves major frustration.

5. Forgetting to Sign or Properly Submit Your Return

Believe it or not, unsigned returns remain a recurring issue. An unsigned tax return is treated as invalid. For electronic filing, missing PIN authentication can cause similar problems.

This error is easily preventable but still costs taxpayers time and processing delays.

How to avoid it:

- Confirm signature requirements before submitting.

- If filing jointly, ensure both spouses sign.

- For e-file, confirm identity verification steps are completed.

6. Failing to Report Investment Income

This is one of the more financially costly mistakes I see among investors. Every year, brokerage firms report dividends, interest, and capital gains directly to the IRS via Forms 1099.

If you forget to include even one 1099—whether from a brokerage account, bank interest, or cryptocurrency platform—the IRS matching system will likely detect it.

Unreported income typically results in a CP2000 notice and additional taxes owed, often with interest.

How to avoid it:

- Wait until you receive all Forms 1099 before filing.

- Check for amended 1099s—brokerages sometimes revise them.

- Reconcile your return with year-end brokerage statements.

- Maintain a checklist of all financial accounts.

For investors with multiple brokerage accounts, this step is especially critical.

7. Missing Opportunities to Reduce Taxes

While errors create headaches, missed opportunities quietly cost you money. Many taxpayers focus on avoiding mistakes but fail to optimize deductions and credits available to them.

Commonly overlooked opportunities include:

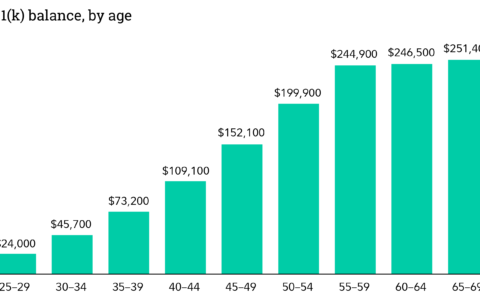

- Contributing to traditional IRAs before the tax filing deadline.

- Funding Health Savings Accounts (HSAs).

- Utilizing above-the-line deductions.

- Harvesting tax losses in brokerage accounts.

For example, strategic tax-loss harvesting in taxable investment accounts can offset capital gains and reduce your overall tax burden. Failing to plan for this before year-end means the opportunity is gone.

How to avoid it:

- Conduct a year-end tax review in November or December.

- Coordinate investment decisions with tax planning.

- Consider “bunching” deductions in high-income years.

- Review whether Roth conversions make sense in lower-income years.

Tax planning is not something that happens in April—it’s a year-round discipline.

8. Not Adjusting to Recent Tax Law Changes

Tax laws evolve. Credits expand, deductions phase out, income thresholds shift. Recent legislative changes have introduced new or modified tax benefits that many taxpayers overlook simply because they rely on outdated assumptions.

For example, expanded credits in certain years may have temporarily increased eligibility, only to revert or phase out later. Failing to stay informed can mean under-claiming credits or misapplying new rules.

How to avoid it:

- Review IRS updates annually.

- Avoid assuming last year’s rules still apply.

- If your income or family structure changes, revisit eligibility for credits and deductions.

- Work with professionals who stay current on tax legislation.

Tax law complexity is increasing—not decreasing. Staying proactive is essential.

The Bigger Risk: Missed Opportunities, Not IRS Penalties

For most taxpayers, the greatest financial loss doesn’t come from IRS penalties. It comes from missed savings.

Over time, small oversights—unclaimed credits, unoptimized retirement contributions, unharvested losses—compound. The difference between reactive tax filing and proactive tax planning can amount to thousands of dollars annually.

As a financial advisor, I encourage clients to view taxes as part of their broader wealth strategy. Investment planning, retirement planning, estate planning, and tax strategy are interconnected.

How Careful Planning Pays Off

Avoiding tax pitfalls doesn’t require perfection—it requires process.

Here’s a practical framework:

- Organize documentation early.

- Conduct a mid-year tax check-in.

- Review withholding and estimated payments.

- Integrate tax planning with investment strategy.

- Consult professionals when complexity increases.

A modest investment of time—along with qualified guidance—can improve not only compliance but overall financial efficiency.

Final Thoughts

Most tax mistakes aren’t dramatic. They’re ordinary. A missed signature. A forgotten 1099. An overlooked credit. A filing status box checked incorrectly.

Yet collectively, these small errors and missed opportunities can erode your financial progress.

By slowing down, double-checking details, and approaching taxes strategically rather than reactively, you can:

- Minimize IRS notices

- Reduce stress

- Capture legitimate tax savings

- Keep more of what you earn

Careful planning is not just about avoiding trouble—it’s about building wealth intelligently.

And in a world where tax rules are continually evolving, proactive attention is one of the smartest investments you can make.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/smart-tax-strategy-8-costly-pitfalls-to-avoid-and-how-proactive-planning-protects-your-wealth.html