The 1970s were marked by a period of high inflation in the United States, also known as stagflation. This period was characterized by both high inflation and high unemployment, which had a significant impact on the economy and the daily lives of individuals.

One of the main causes of the 1970s inflation was the increase in oil prices as a result of the 1973 oil crisis. The crisis, caused by an embargo imposed by OPEC (the Organization of the Petroleum Exporting Countries), led to a sharp increase in the price of oil, which in turn led to an increase in the overall level of prices. Additionally, the government’s expansionary monetary and fiscal policies, such as the increase in government spending and decrease in taxes, also contributed to the inflation.

The high inflation of the 1970s led to a significant increase in the cost of living for the average American. Prices for goods and services such as food, gas, and housing rose dramatically, making it harder for individuals to afford the things they needed. The high inflation also led to a decrease in overall living standards and disproportionately affected low-income individuals and households.

The government, led by President Richard Nixon and later by President Gerald Ford, attempted to combat the inflation through a variety of measures such as wage and price controls, monetary tightening, and fiscal austerity. However, these measures were not entirely successful in bringing down inflation.

On the other hand, during the 1970s inflation crisis, the Federal Reserve, the central bank of the United States, attempted to combat inflation through a variety of monetary policy tools. The Federal Reserve was led by several different chairmen during this period, including Arthur Burns (1970-1978), G. William Miller (1978-1979) and Paul Volcker (1979-1987).

During the 1970s, the Federal Reserve attempted to combat inflation through a variety of monetary policy tools such as raising interest rates, which makes borrowing more expensive and can slow down economic growth. However, these measures were not entirely successful in bringing down inflation.

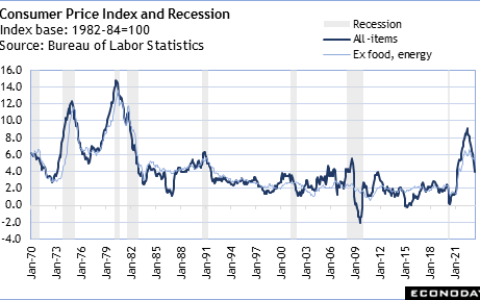

In 1979, Paul Volcker, who was appointed as the chairman of the Federal Reserve by President Jimmy Carter, adopted a new approach to combat inflation by implementing a tight monetary policy, which included raising the federal funds rate, the interest rate at which banks lend money to each other overnight, to historically high levels, which reached as high as 20% by 1981. This tight monetary policy led to a recession in the early 1980s, but it also helped to bring down inflation.

The Federal Reserve, under the leadership of several different chairmen during the 1970s, attempted to combat inflation through a variety of monetary policy tools, but it was not until the implementation of tight monetary policy by Paul Volcker, that the inflation rate was finally brought under control.

The inflation of the 1970s persisted for several years, with the inflation rate reaching a peak of over 12% in 1974. It was not until the early 1980s, under the leadership of President Ronald Reagan, that the government’s monetary and fiscal policies, combined with a decrease in oil prices, were able to bring the inflation under control.

The 1970s inflation serves as a reminder of the importance of sound economic policies and the potential consequences of not addressing inflation in a timely manner. It also highlights the interconnectedness of the global economy and the potential impact of events such as oil crises on inflation. Additionally, it serves as a reminder that inflation can have a significant impact on the daily lives of individuals and the overall economy, and that it is important for the government to take measures to address it in a timely and effective manner.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/the-1970s-inflation-crisis-causes-effects-and-lessons-learned.html

Comments(1)

If you desire to improve your experience only keep visiting this web page and be updated with the latest gossip posted here.