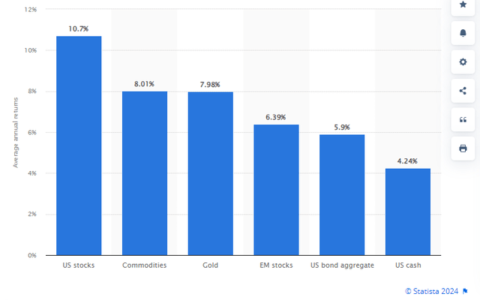

If you’re seeking opportunities to invest in the gold and silver industry, you’re in luck. In 2023, there are several factors that suggest gold and gold miners may be successful investments and outperform the general markets. Factors likely to impact the price of gold in 2023 include an increase in central bank purchases, rising jewelry demand, and limited gold mine supply.

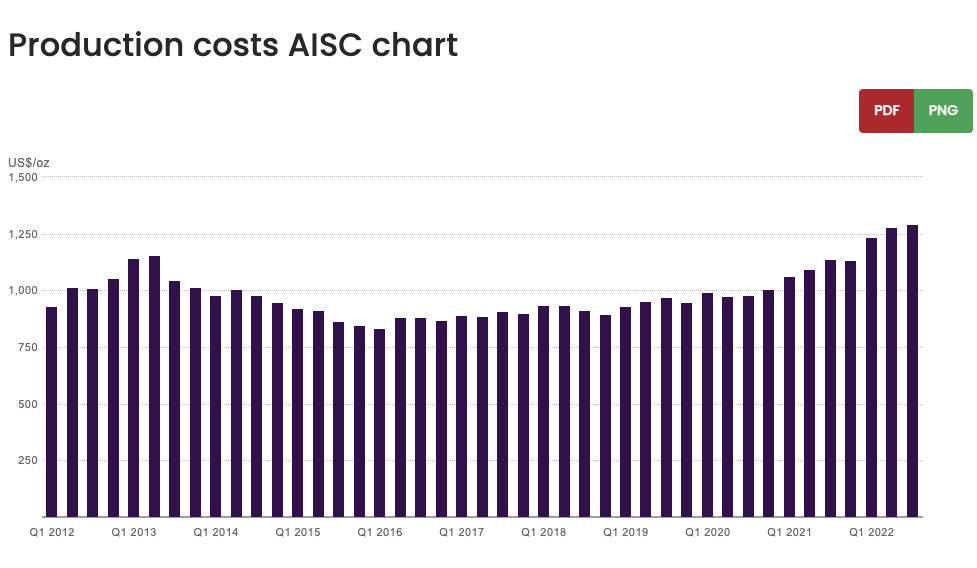

Gold (GLD), Gold miners (GDX), in particular, can provide investors with leverage to gold prices and the possibility of strong risk-adjusted returns. Despite a challenging year in 2022, gold miners are currently undervalued according to various valuation metrics and have strong financial foundations, carrying the lowest debt and most cash on the balance sheets in years.In times of economic uncertainty, investors tend to flock to gold as a hedge against inflation and a store of value. With the world facing a number of economic and geopolitical challenges in 2023, it’s likely that the price of gold will continue to rise.

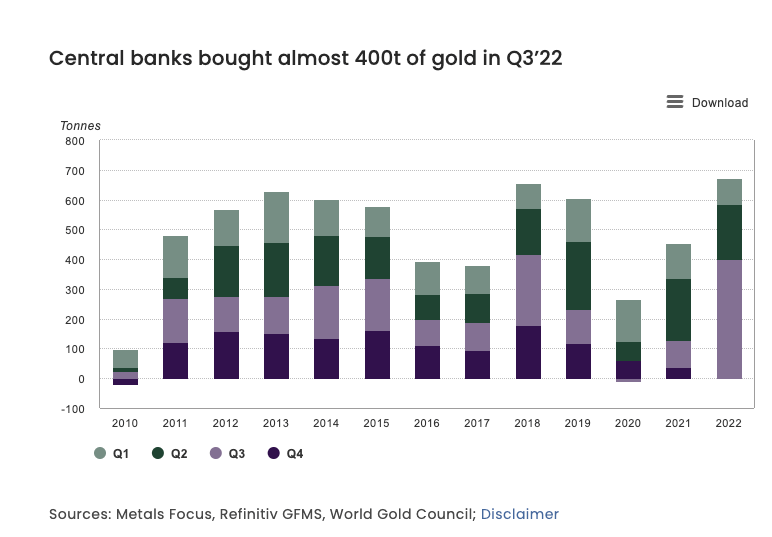

One of the main drivers of this trend is the increasing demand for gold from central banks. In particular, China has been on a buying spree in recent years, as it looks to diversify its foreign exchange reserves away from the U.S. dollar. This trend is likely to continue in 2023, as the Chinese government continues to look for ways to protect its economy from the effects of a weakening U.S. dollar.

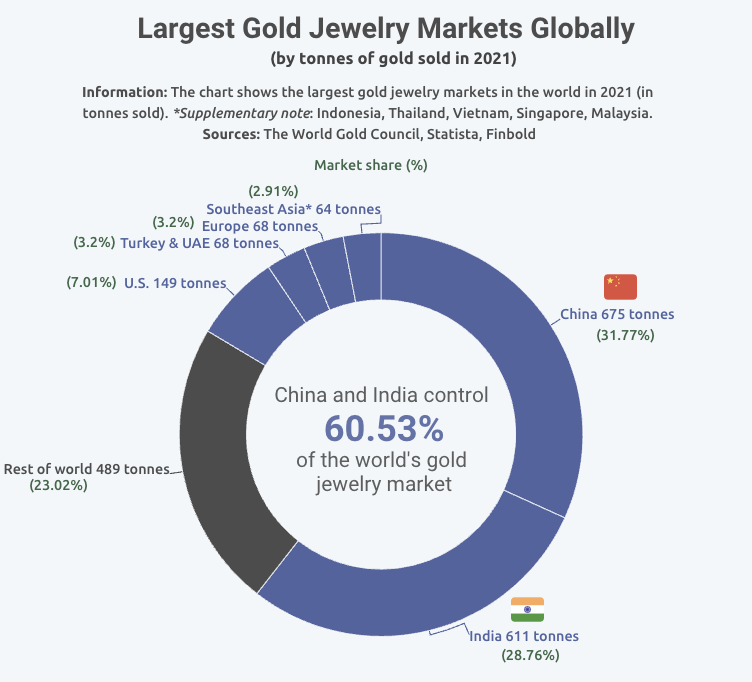

Another factor that will likely boost the price of gold in 2023 is a rebound in jewelry demand. In recent years, demand for gold jewelry has been hit by a number of factors, including a rise in the price of gold and a shift in consumer preferences towards other types of luxury goods. However, as the global economy continues to recover from the pandemic, it’s likely that demand for gold jewelry will pick up again.

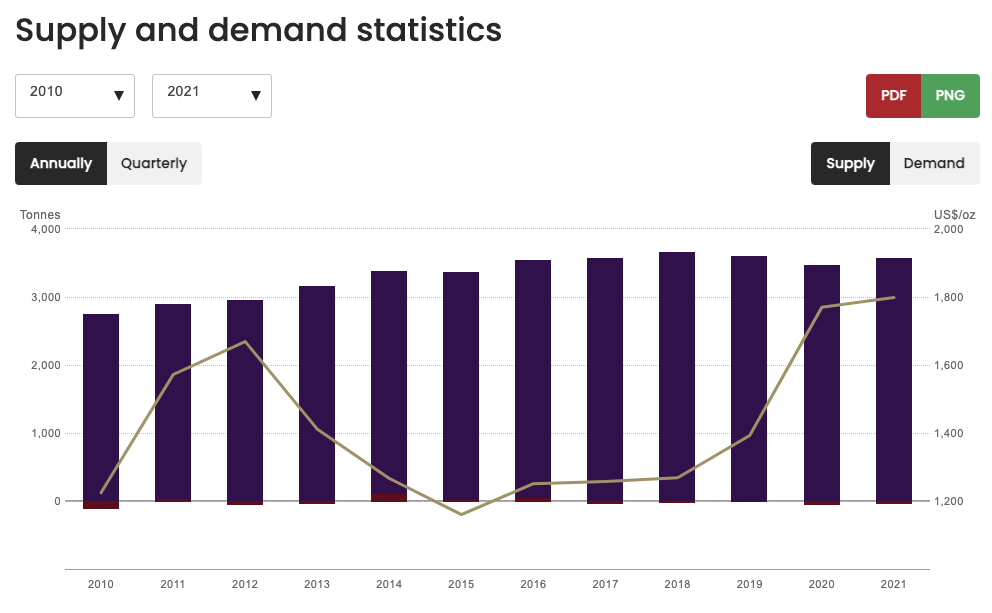

In addition to these factors, the limited new mine supply of gold will also play a role in pushing up the price. With many mining companies struggling to find new deposits of gold, the supply of gold is likely to remain tight in 2023. This, combined with strong demand, will put upward pressure on the price of gold.

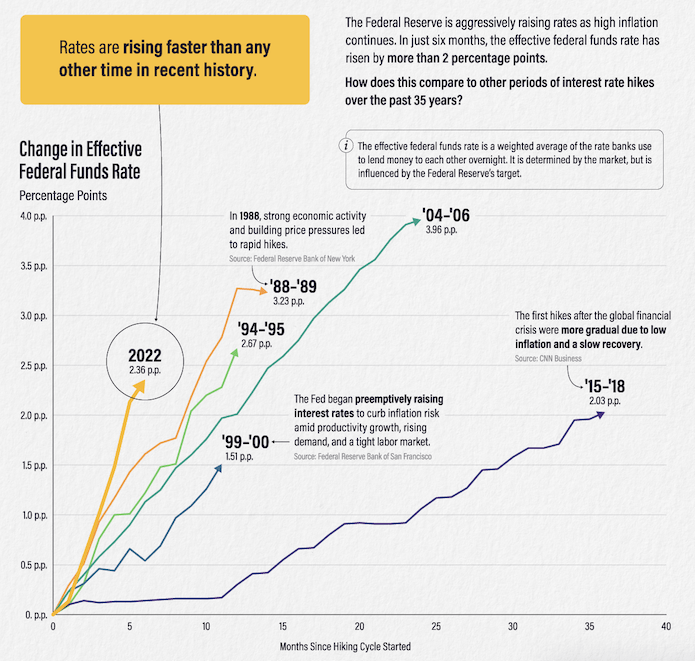

Another important factor to consider is the Federal Reserve’s eventual pivot to rate cuts. The Fed has been in a tightening cycle for the past few years, but as the economy continues to face headwinds, it’s likely that the central bank will begin cutting interest rates again. This is good news for gold, as lower interest rates make it less attractive to hold cash, and more attractive to hold assets like gold that pay no interest.

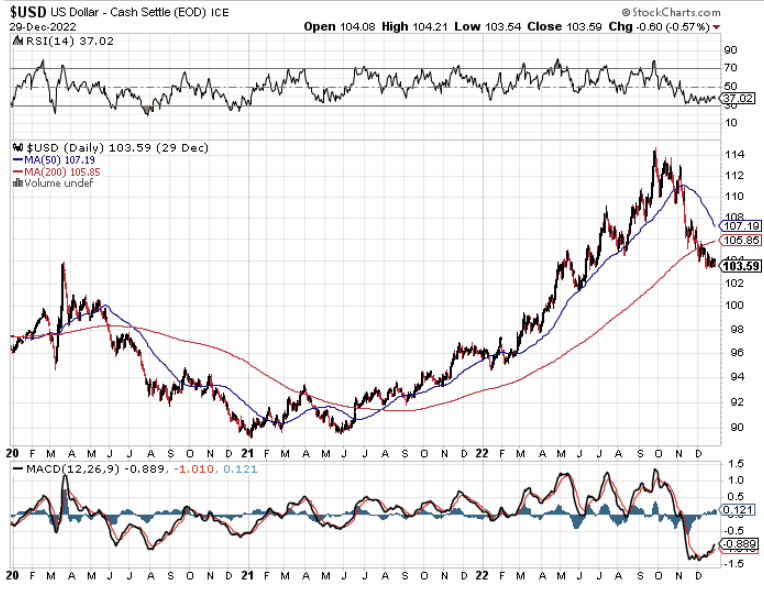

The weakening U.S. dollar will also play a role in pushing up the price of gold. As the U.S. dollar loses value against other currencies, gold becomes more expensive for buyers using other currencies. Additionally, gold is often seen as a safe haven during political crisis and geopolitical tensions, such as the escalating war in Ukraine, which can also drive demand and price of gold.

In conclusion, there are a number of factors that suggest the price of gold will continue to rise in 2023. With strong demand from central banks, a rebound in jewelry demand, limited new mine supply, a possible pivot to rate cuts by the Fed, weakening U.S. dollar, and geopolitical tensions, gold is well-positioned to perform well in the coming year. As an investor, gold should be considered as a valuable addition to your portfolio, as it can provide a hedge against inflation and a store of value in uncertain times.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/why-gold-price-is-poised-to-rise-in-2023-a-look-at-the-factors-driving-the-market.html

Comments(1)

Global gold demand reached an 11-year high in 2022, driven by retail investors and central banks shoring up their bullion reserves. According to the World Gold Council, demand rose by 18% to 4,741 tonnes last year, with 1,136 tonnes bought by central banks. Investment demand for gold was up 10% from the previous year, with retail investor demand driven by a notable slowdown in ETF outflows and strong gold bar and coin demand. Jewelry consumption dropped 3% in 2022, but it was still at a nine-year high. The gold price hit a record annual average of $1,800 per ounce last year, despite facing headwinds from the strong US dollar and rising global interest rates. Central bank net purchases in the fourth quarter totaled 417 tonnes, lifting the second half total buying to 862 tonnes. Much of the central bank gold buying in 2022 came from emerging markets, such as Turkey, China, Egypt, and Qatar.