The coming year is sure to bring a lot of uncertainty in the financial markets. But if you’re looking for a safe and reliable investment option, silver may be the perfect choice. With silver prices showing signs of increasing in 2023, silver investing could be a great way to diversify your portfolio and reap the rewards of a precious metal that has an incredible history of growth and stability. In this article, we’ll explore the benefits of investing in silver, the impact of the US dollar’s decline, and the best strategies to maximize your returns.

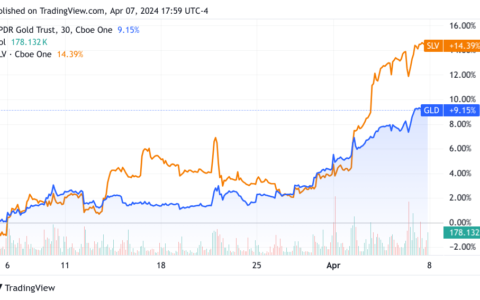

The iShares Silver Trust ETF (NYSEARCA:SLV) is a simple and convenient way for investors to gain exposure to the silver market without the need to purchase and store physical silver. The correlation between SLV and spot silver (XAGUSD:CUR) is generally very strong. Spot silver is the current market price at which silver is being bought and sold for immediate delivery. However, SLV is designed to track the spot price of silver as closely as possible, and the value of the ETF is based on the value of the underlying physical silver that it holds.

The spot silver has developed a strong bottom at a long-term support level of $17.60 and is now moving higher. Due to the high inflation, rising interest rates, high debt, and a slowing U.S. economy, the silver market is projected to gain strength and remain strong in 2023. On the other hand, the gold-silver ratio peaked in 2020 and is now declining with a bearish technical formation. The decline in the gold-silver ratio has increased the likelihood of a significant silver rally in the coming years. The initial resistance in the spot silver market is $35, with a long-term objective of $50. Nonetheless, the development of the cup and handle on the yearly chart implies that a breakout above $50 could result in a powerful millennium rally in the silver market. The price structure of the silver market is extremely bullish on all respective long-term charts, with $19-$20 serving as a strong buying opportunity for long-term investors.

Silver Benefits From US Dollar Decline

The US dollar has been in a long term decline since the start of 2020, and this trend is expected to continue into 2023. As the US dollar depreciates, silver prices typically increase as investors seek out a safe haven asset. With the US dollar weakening, silver could see a boost in its price and provide investors with an opportunity to capitalize on the declining value of the US currency.

Silver To Benefit From Economic Slowdown

As economic conditions continue to be uncertain in the coming year, investors may be looking for alternative investments to protect their portfolios. Silver provides a safe haven asset that could help investors to protect their assets from a potential economic downturn. Silver is a great hedge against inflation, and its low correlation to other asset classes makes it an ideal choice for portfolio diversification.

Gold Silver Ratio An Indicator To Buy Silver

The gold silver ratio is a key indicator for investors who want to know when it’s the best time to buy silver. Generally, if the ratio is above 80, it’s a good time to buy silver as the price of silver is comparatively lower than gold. Conversely, if the ratio is below 80, it’s time to sell silver as the price of silver is comparatively higher than gold.

Technical Parameters For Silver Market

Technical analysis is a great way to stay on top of silver market trends. By examining price charts, moving averages, and other technical indicators, investors can identify when it’s a good time to buy or sell silver. Technical analysis can also help investors to identify support and resistance levels, which can be used to determine entry and exit points for silver investments.

Market Risks

As with any investment, there are always risks associated with silver investing. The price of silver is highly volatile and can be subject to large fluctuations. As silver is a commodity, its price is heavily influenced by supply and demand, so it’s important to pay attention to global economic events that could affect the supply and demand of silver. Additionally, investors should keep an eye on the gold silver ratio and other indicators to help inform their investment decisions.

Conclusion

Silver is an excellent investment option for 2023, as it provides a safe haven asset that can help protect portfolios from potential market downturns. Silver is also expected to benefit from the US dollar’s decline and could be a great way to diversify your portfolio. Lastly, investors should consider the gold silver ratio, technical parameters, and market risks when making their silver investments.

Top Ten Key Takeaways

1. Silver is a great safe haven asset for 2023.

2. Silver prices are expected to increase in 2023 due to the US dollar’s decline.

3. The gold silver ratio is an indicator to determine when it’s the best time to buy or sell silver.

4. Technical analysis can help investors identify entry and exit points for silver investments.

5. Market risks should be taken into consideration when investing in silver.

6. Silver is a good hedge against inflation.

7. Silver has a low correlation to other asset classes, making it an ideal choice for portfolio diversification.

8. Silver investments can provide investors with long term returns.

9. Silver bullion, coins, stocks, ETFs, and other investments are all options for silver investors.

10. Investors should consult a professional financial advisor when making silver investments.

Take advantage of silver’s potential in 2023 and start investing in silver today! With the right portfolio management and investing strategies, silver could be the perfect addition to your portfolio.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/why-silver-is-my-favorite-investment-for-2023.html